What is an IVA Debt Solution?

Unlike bankruptcy, the IVA debt solution is a formal legal agreement between the debtor and creditors. It’s a way to arrange affordable repayments and protect assets. When an IVA is complete, all unsecured debt is written off. This allows debtors to keep their property and cars. The debtor can also make payments on secured loans without losing them.

An IVA debt solution is a real option for struggling debtors. An insolvency practitioner will analyse your financial situation, identify a suitable debt solution and then put your case forward to your creditors. If your financial situation improves, you may no longer need an IVA. If you are still struggling, it’s important to seek advice from a debt adviser. The advisor will analyse your financial situation, suggest a suitable debt solution and then appoint an insolvency practitioner to carry out the arrangement.

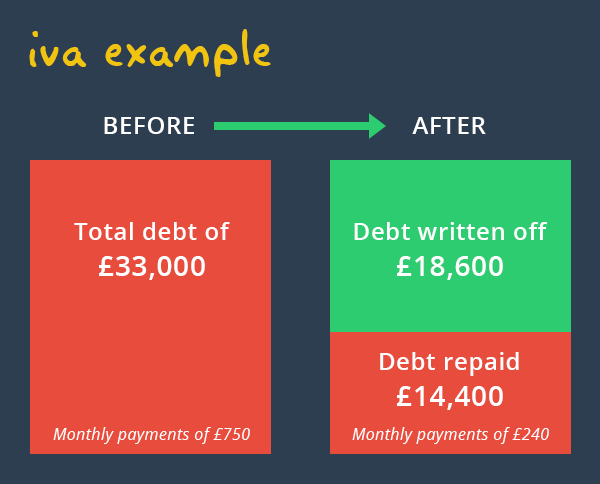

Generally, an IVA will last for five to six years. The IVA debt solution will take care of all your debts, including unsecured debts and those with mortgages or secured loans. It will allow you to pay off your debts with a single reduced payment every month. The monthly amount payable will be based on the normal costs of living, taking into account your household income.

During the IVA, your creditors are prohibited from adding more interest to your accounts. You can also have your IVA written off at the end of the arrangement. Your creditors will not be able to add further charges to your account, and you cannot be sued for non-payment.

The IVA debt solution is a flexible approach that doesn’t require you to give up any of your assets. This means you can maintain your home, keep a car, and keep any financed vehicles. However, you must continue making mortgage and secured loan payments.

An IVA is a legally binding agreement that is signed by both the debtor and their creditors. You will need to pay an initial set-up fee to the insolvency practitioner. This will go towards the cost of establishing the IVA. You will need to meet a minimum of PS80 per month to qualify. The repayment period is normally 60 months, but this can be extended for homeowners with equity.

The IVA debt solution is mainly structured around a low-cost, monthly payment, which is agreed with your creditors. This can be renegotiated, but you will need to tell your debt adviser about any changes in your finances. The IVA will usually be for a fixed period of five to six years, although some IVAs are for up to nine years.

If you are worried about the effect an IVA will have on your job, it’s important to check your employment contract. It may contain clauses about personal insolvency. If you are in a regulated or disciplined environment, you may need to disclose your plans to your employer in advance. If you are an accountant, you are likely not eligible for an IVA.

IVAs can be difficult to manage. The insolvency practitioner will conduct periodic reviews of your financial situation and deal with any queries from your creditors. If you miss a payment, your creditor may request a meeting with the IP to discuss your financial situation. If the IP fails to resolve the issue, the debtor can stop making payments without obtaining an IVA discharge.

What is an IVA Debt Solution? was first seen on Debt Worries