Debt Settlement Offer – How to Negotiate a Debt Settlement Offer

Getting a debt settlement offer from a creditor is a great way to get out of debt for less. However, you should take your time when deciding whether to accept the settlement offer. You want to make sure you read the offer thoroughly and find out what you can do to improve your bargaining position. Also, you should have a lawyer review the offer before deciding to accept it.

First, you need to determine how much you can afford to pay to settle your debt. Some debts can be settled by taking a lump sum payment, while other debts require monthly payments. You can also decide to negotiate the amount of the settlement on your own. But be aware that you may need to have a large cash reserve to be successful.

Once you have a general idea of how much you can afford to pay, you should work out a specific dollar amount that you can offer. A good starting point for a debt settlement offer is about 30% to 40% of your balance owing. The creditor will probably not accept an offer lower than this, though they may be willing to negotiate a reduction if you have been late on your payments. If you can’t pay the full amount of your balance, you might want to look into other options, such as a hardship payment plan.

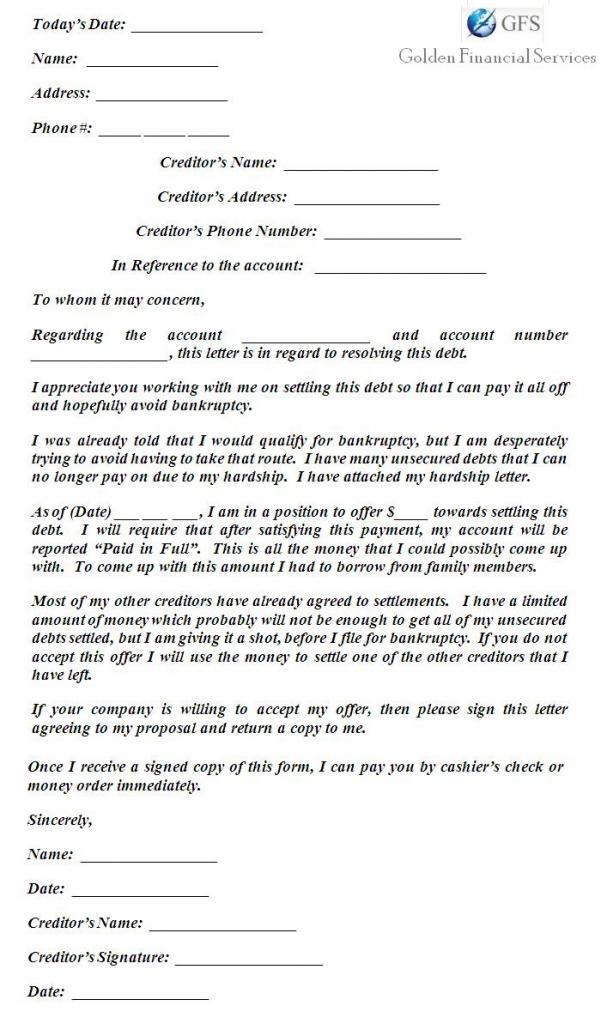

Once you’ve worked out how much you can pay to settle your debt, you should write a letter to the creditor explaining your situation. This letter can include proof of financial hardship, such as an unexpected medical bill. You should also include your name and account number, as well as your mailing address.

You should never send a settlement letter to a collection agency or other debtor without having a formal agreement. If you don’t have a contract in place, you should consider filing a lawsuit in civil court. This is an effective way to stop a debt collector from attempting to collect your money. You should also keep a copy of your settlement letter and any other confirmations you receive.

If you’ve received a debt settlement offer from a collection agency, you should send a counteroffer letter to the creditor. This letter is designed to help you get out of debt for less. The settlement will be reported to the credit bureaus, so you should consider the statute of limitations on the debt. You might also be able to negotiate with the collection agency for a lower settlement.

Before accepting a debt settlement offer, you should research the company you’re dealing with. This will give you more insight into the company’s practices. Beware of companies that charge a high fee, but don’t do any of the work. You should also be on the lookout for fake letters and debts. You should also avoid signing up with a company that requires you to pay upfront fees. You can get advice from a debt counselor or other debt professional to find out more about the best ways to negotiate a settlement.

Debt Settlement Offer – How to Negotiate a Debt Settlement Offer was first seen on Help with My Debt