IVA Debt Relief – What You Need to Know About IVA Debt Relief

During an IVA, the debtor agrees to pay the creditors back over an agreed period of time. The amount that is paid back is based on the income and expenditure of the debtor and any priority commitments that have been agreed. The insolvency practitioner (IP) assists the debtor in making the payments. IPs are regulated by professional bodies.

The IP will ask you to complete an income and expenditure form to help them determine how much surplus income you have. This is needed to calculate the monthly amount that you will be able to afford. The IP will then write up a proposal to your creditors, which is more attractive than bankruptcy. In addition to this, the IP will also be able to discuss options with you. The IP will also be responsible for making changes to your Direct Debit. If you have any issues making payments, it is best to contact the IP immediately.

If you are a homeowner, you will be expected to release some equity in your home to your creditors. This release of equity is usually done by remortgaging the property or making an extra year of monthly payments into the IVA. This means that you will no longer be in possession of the property. However, it is important to note that an IVA does not protect other people in your household from liability. For example, if you have a joint loan with someone else, this does not protect you.

There are some exceptions to this rule. For example, if you are a company director, an IVA does not affect your ability to hold public office. However, if you own a vehicle, you will have to provide proof that you can afford to operate the vehicle. Also, if you have a lease on the vehicle, you may have to repay the remaining balance.

Another option is to get a debt management plan. This is a less formal insolvency option, which does not write off the debts and does not include a formal registration. It does not take into account assets and may not last as long as an IVA. However, this plan is more flexible. If you are unable to keep up with the payments, you can cancel the plan.

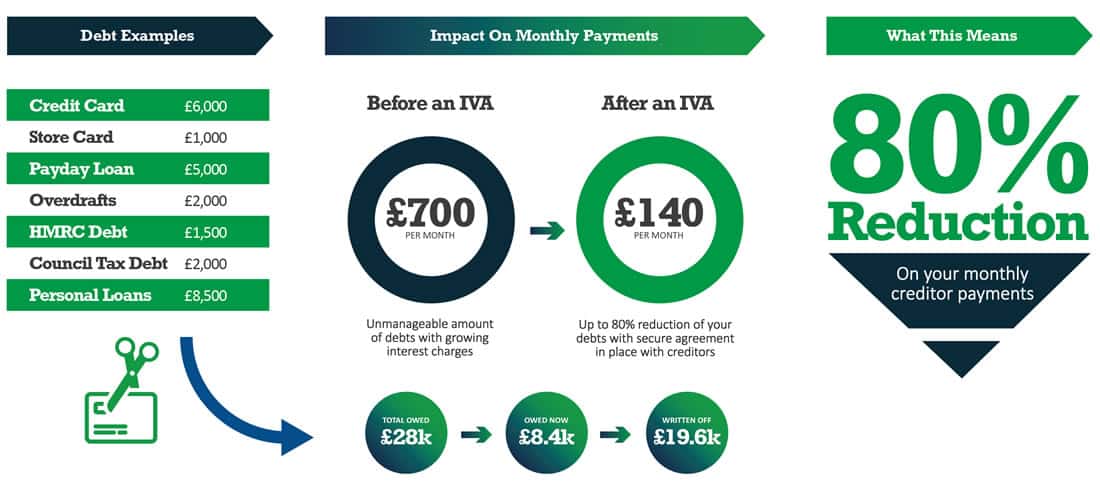

Another option is to apply for an Individual Voluntary Arrangement (IVA). In this type of insolvency, the debtor agrees to pay back a percentage of their debt. This is based on their income and the normal costs of living. The IVA is a legal agreement that protects the debtor from bailiffs and other legal action. During an IVA, the interest on unsecured debt is frozen. Upon completion of the IVA, the debt is written off.

However, an IVA will affect your credit rating. Your creditors will be able to see that you are in an IVA. This is why it is important to keep your credit file updated. If you receive a letter from your creditors that threatens legal action, it is important to report it to the IP.

IVA Debt Relief – What You Need to Know About IVA Debt Relief was first seen on Apply for an IVA