IVA Debt Relief – What is an IVA?

An IVA, or Individual Voluntary Arrangement, is a debt solution that provides relief to people who are struggling with debt. It is a legal and binding arrangement that prevents creditors from taking action to recover money owed. When you take an IVA, you will be given a fixed amount of time to pay off the amount of debt you owe. This gives you the opportunity to work out a repayment plan that suits your financial circumstances. The details of your plan are recorded on your credit file for six years. Once you have finished paying off the debt in your IVA, you will be able to resume making payments normally. If you are unsure whether an IVA is right for you, it’s best to seek advice.

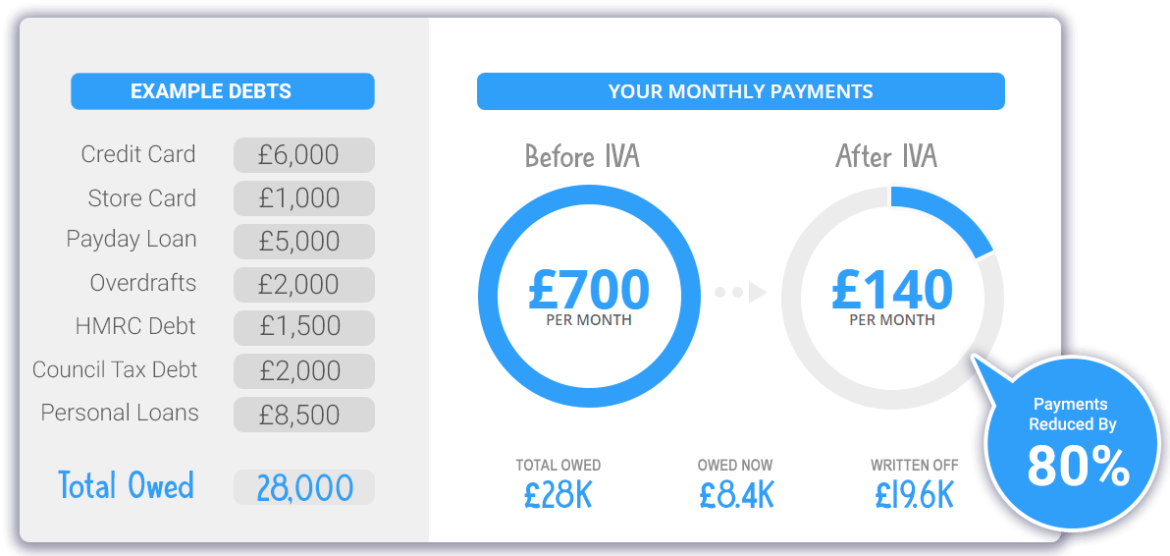

IVAs are designed to help you reduce your debt and keep your assets. In many cases, your IVA will include a repayment plan that involves making monthly payments to your creditors. However, you must be able to afford the monthly payments. You can also decide to make a lump sum payment to your creditors.

There are several advantages of an IVA. For example, it may be possible to keep your home. Additionally, creditors will not be able to recoup interest or fees from you. Depending on the agreement, you will have to pay up to 75% of your debt.

A successful IVA is a great way to regain control of your finances. However, you must adhere to the terms of the proposal and make all payments on time. Also, you need to be honest with your IP. While the debt adviser is responsible for presenting the best case, you must tell the IP what you are really able to afford to repay.

An IVA is an alternative to bankruptcy. As a result, it is a ‘legally binding’ debt solution that allows you to make affordable repayments over a period of time. Most IVAs last for five or six years, but they can also be extended for up to a year if you are unable to re-mortgage your property.

When you apply for an IVA, you’ll need to supply proof of income and assets. Your IP will then assess your situation and develop a proposal. These are typically based on monthly income and expenditure. You will be able to work with your IP to create a reasonable and affordable repayment plan that your creditors will be able to accept.

During the IVA, you’ll need to attend periodic reviews. At the beginning of the agreement, your creditors will be notified that you are entering an IVA. They will be given an opportunity to counter any proposal or ask you to change the repayment plan. Make sure that you inform your supervisor of any changes in your circumstances. If you fail to do this, you could find yourself being written off as insolvent.

IVAs are a great way to relieve stress and make your finances more manageable. However, they can be complicated to understand. Be honest with your IP and remember that every debt solution has its drawbacks.

IVA Debt Relief – What is an IVA? was first seen on Help with My Debt