Debt Consolidation – What You Need to Know Before Getting a Debt Consolidation Loan

Debt consolidation is a great way to streamline your finances. By consolidating your debts into a single loan, you can pay them off more easily and save money on interest. However, there are a few things you need to know before getting a consolidation loan.

First, you will need to evaluate your financial situation and decide whether you qualify for a consolidation loan. You will also need to compare the interest rates and fees on the loans available. This can help you determine which is the best option for you.

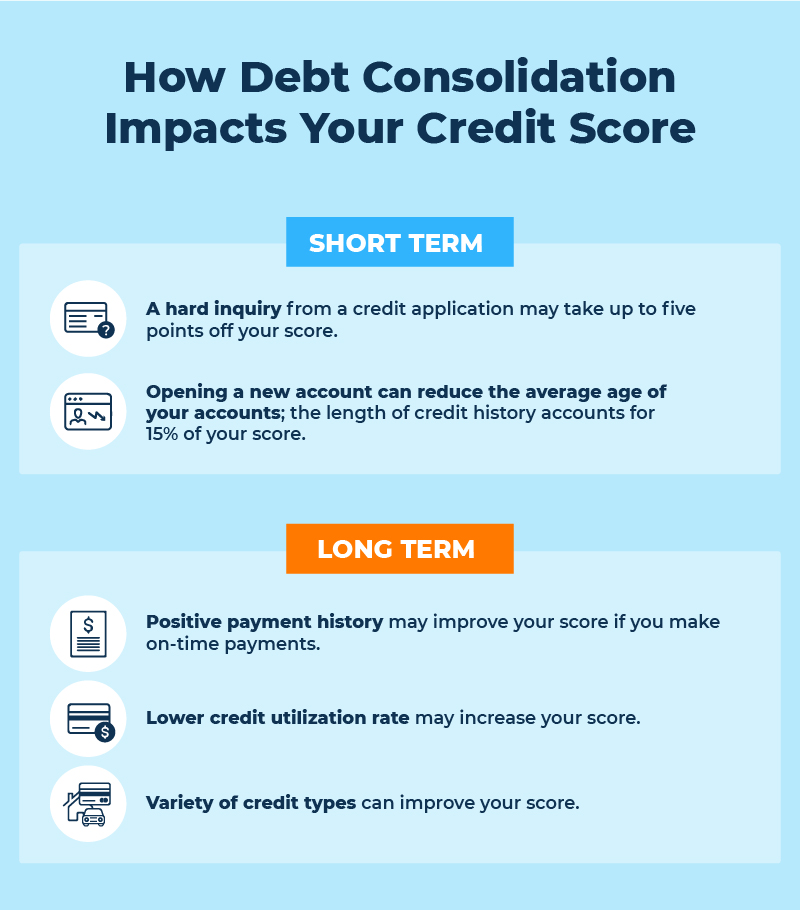

In addition to reducing your monthly payments, a consolidation loan may also help you improve your credit. Having a lower credit utilization ratio can help you build a good FICO score. A good credit rating can mean the difference between a low or high interest rate.

Another benefit of consolidating your debt is the reduction of collection calls. When you make just one payment each month, you are less likely to miss a payment. But, even if you are disciplined, you may not be able to eliminate all of your debts without consolidation. Before you start applying for a consolidation loan, you should get a feel for your budget and your current spending habits.

If you are considering consolidating your debt, you should also consider the best repayment schedule for you. Shorter repayment periods are typically the best, since you can save on interest and avoid paying extra fees. Longer repayment terms can also be beneficial, but you will need to keep in mind that you will be paying a higher interest rate.

Debt consolidation is not for everyone. You should only consider this option if you are able to handle a monthly payment, have a credit score above 700, and are in a solid financial position. It is not a solution for bad financial behaviors.

Taking out a debt consolidation loan is a wise investment, but it doesn’t mean it will work for every individual. Some people might not be able to qualify for a consolidation loan or would receive an unfavorable interest rate.

Although a consolidation loan can save you money and make repaying your debts more manageable, the decision to take out a consolidation loan is not something to take lightly. There are a few things you need to consider, including how much you can afford to borrow, your repayment history, and the fees associated with your new loan.

Whether you opt for a consolidation loan or another traditional loan, the key is to shop around. Many lenders offer prequalification, which allows you to get an estimate of your potential interest rates and fees. The lender will then review your application and credit report to determine your eligibility. While a prequalification doesn’t guarantee a loan, it is an easy way to understand the terms and conditions of your new loan.

After your loan is approved, you will begin making your new payments. Consolidating your debt will make your life easier, but you will need to be disciplined. Otherwise, you might find yourself slipping behind on your payments and paying more in interest than you were originally planning.

Debt Consolidation – What You Need to Know Before Getting a Debt Consolidation Loan was first seen on Apply for an IVA