How to Get Out of Debt – How to Get Help Paying Off College Loans

If you’re struggling to pay off a college loan, there are ways to get help. There are income-based repayment plans and student loan forgiveness programs. It’s important to get out of debt because debt can negatively impact your health and mental well-being. The first step in getting out of debt is to accept responsibility for your debt. Gather all of your financial documents and make a list of all current debts. Next, get copies of your credit reports. These can contain information such as how much you owe, how long it’s been in collections, and who the creditors are.

Next, start planning how you’re going to pay off your debts. Make a plan so you can avoid paying extra interest. Having a plan will help you make a budget, which will make it much easier to keep track of payments. You may also want to get an education about all your debts, so that you know exactly what you owe and how much you need to pay. Getting out of debt doesn’t have to be overwhelming, and you can find inspiration from other people’s experiences. You might want to check out Brian Brandow’s story, who managed to overcome $109,000 in debt. During a difficult time, he maxed out five credit cards.

Another key step in getting out of debt is changing your mindset. If you’re struggling with debt, you’ll want to make a new commitment to not just make your payments on time, but to start saving for retirement or an emergency fund. This will ensure that you don’t get further into debt. A good financial coach can help you make these changes. The sooner you start reshaping your mindset, the sooner you’ll be debt-free.

Once you’ve made a plan, make sure to stick to it. Then, keep track of your monthly progress. As long as you can make progress every month, you’ll eventually eliminate your debt. You’ll feel a whole lot better about yourself when you can finally start living a debt-free life.

Next, you should talk to your lenders. Start with your best bank and try to negotiate with them. Be prepared to explain your financial situation. You should be able to show your lender that you’ve been careful with your finances and that you’re taking steps to avoid defaulting on your debts. If this fails, you can also hire a debt relief company to help you out of debt.

Another key step in getting out of debt is setting up a budget. By keeping track of your expenses, you can find areas you can cut back on without compromising your lifestyle. Ideally, you should pay at least 20% of your income towards your debts. If you can afford it, make extra payments. This will not only cut your payoff time, but it will also lower your credit utilization ratio, which is good for your credit score.

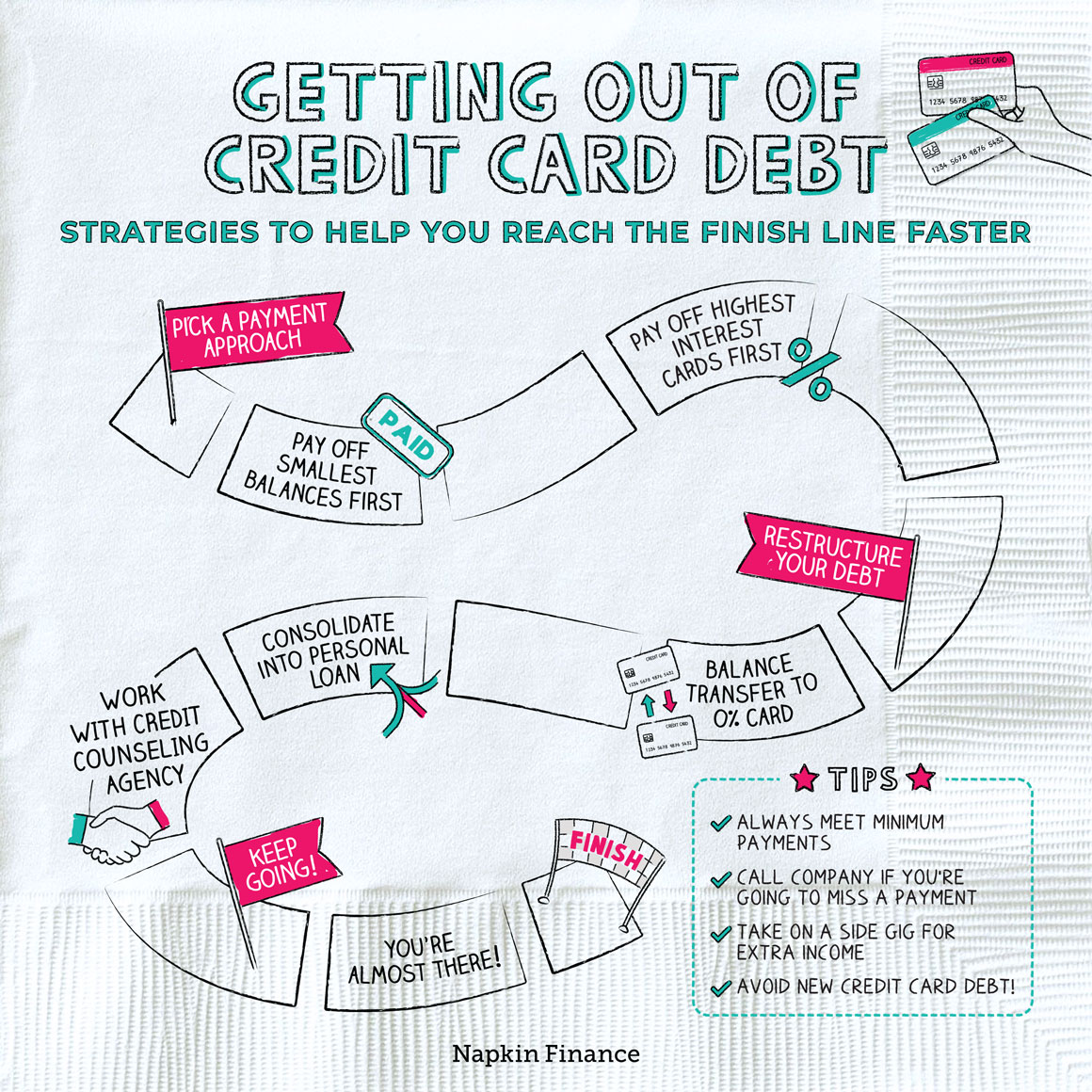

It is important to note that getting out of debt is not an easy task. It’s often hard to prioritize monthly bills and minimum payments on your credit cards. However, it doesn’t have to be a nightmare. Achieving your debt repayment goals can be done by following a step-by-step action plan. You can also use a debt repayment calculator to determine how long it will take you to pay off your debts.

How to Get Out of Debt – How to Get Help Paying Off College Loans was first seen on Apply for an IVA