Debt Management Programs

Debt Management programs are a great way to reduce debt and restore your credit score. These plans can help you pay off your outstanding balances while progressively shrinking your credit card balances. These plans are often suitable for those with unsecured debt and multiple credit cards. They can also improve your credit score if you’ve missed payments in the past.

Debt management strategies can include creating a budget and setting priorities. You can also negotiate with creditors to lower interest rates and monthly payments. Debt counselors are also available to assist with debt problems. You can search for one near you by visiting the National Foundation of Credit Counselors’ directory. Before signing up, read reviews about the counselor’s services and make sure you understand all of the fees.

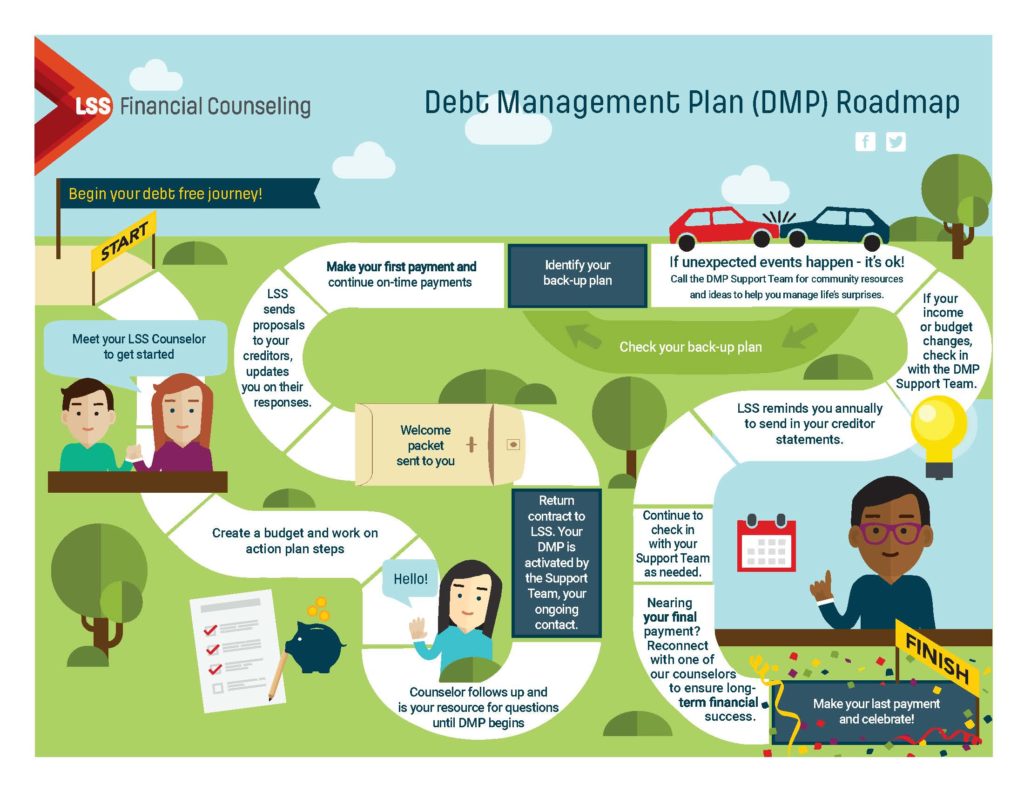

Once you’ve enrolled, the debt counselor will contact your creditors on your behalf and ask for concessions. These concessions can include lowering interest rates or re-aging your account to stop late fees. As a result, you can build up a savings account and even buy your first home. Debt counselors can help you determine where to cut costs and create a budget to suit your needs.

Debt management plans help you reduce your interest rates, waive late fees and pay off all unsecured debts over a certain period of time. They are usually set up by nonprofit credit counseling agencies, and aim to help you pay off your debts within three to five years. However, it’s important to remember that DMPs can only be used to pay off unsecured debts and not secured debts or student loans.

Debt management policies should be tailored to the needs of the issuer and should include details of how interest and principal will be capitalized. Debt management policies should also include details about the use of credit ratings and the selection of rating services. Moreover, if a debt management policy includes the use of derivatives, it should specify exactly how the company will use them. For more information, check the GFOA advisory on developing a derivatives policy.

Although debt management plans can help you manage your debts, they’re not for everyone. While they can be beneficial in many ways, you should consider the disadvantages before you make the decision to enroll. For instance, you may be pressured into signing up for a debt management plan when you haven’t decided on it. In addition, some plans can make it harder for you to make payments on time. However, a debt management plan will also provide you with a counselor to motivate you and provide you with a comprehensive strategy to overcome your financial struggles.

Another way to deal with your indebtedness is to hire a debt settlement company. This company promises to negotiate with your creditors on your behalf. They will usually charge a fee for their services. The process is time-consuming, and can be costly. Some companies charge up to 15 to 25 percent of the total amount you owe. This means that if you have $20,000 in consumer debt, you may pay three to five thousand dollars to settle it.

Debt Management Programs was first seen on Debt Worries