How to Ask a Creditor to Write Off Debt

When a person has trouble paying off a debt, they may wish to ask a creditor to write off the debt. This can be done in two ways. It depends on the debt, the expenditure and the likelihood of repayment. However, creditors only write off the debt in exceptional cases.

First, the creditor must be able to prove that you are incapable of paying off your debt. You must provide proof of your financial status, your income and your monthly budget. If you are receiving unemployment benefits, you can demonstrate that your income is not sufficient to pay off your debts.

Secondly, you need to show that your debt is legally unenforceable. This is known as a statute bar. Creditors will not chase a debt if it is a statute bar. In some cases, it can be difficult to prove that a debt is a statute bar. To help determine whether or not your debt is a statute bar, it’s best to contact the Financial Ombudsman.

Finally, a creditor may be more amenable to writing off a debt if you have a serious medical condition. For example, if you have a terminal illness, you may be unable to work and you may be unable to repay your debts. The creditor can take action to write off the debt, but this can be a lengthy process.

Lastly, you may be able to get your debt written off in the form of a legal settlement. Most lenders are commercially minded and only write off debts in exceptional circumstances. They will balance a settlement offer against the costs of pursuing debt recovery. If you are considering taking advantage of this debt solution, make sure that you understand the pitfalls.

For instance, a full or partial write off of your debt will not be visible on your credit record for six years. However, your credit score will be negatively impacted if you have a partially written off debt. As a result, you should be wary of settling any unpaid debts before the deadline.

Regardless of your situation, if you find yourself in the unenviable position of having to ask a creditor to write off a debt, you should know that there are many groups that encourage creditors to do so. Some of these organizations even have websites with information on a variety of debt solutions. There are also debt charities such as StepChange.

A good place to start is by seeking free debt support. These agencies will be able to recommend the most effective debt solution for you. Also, they can help you understand the various debt solutions and their associated costs.

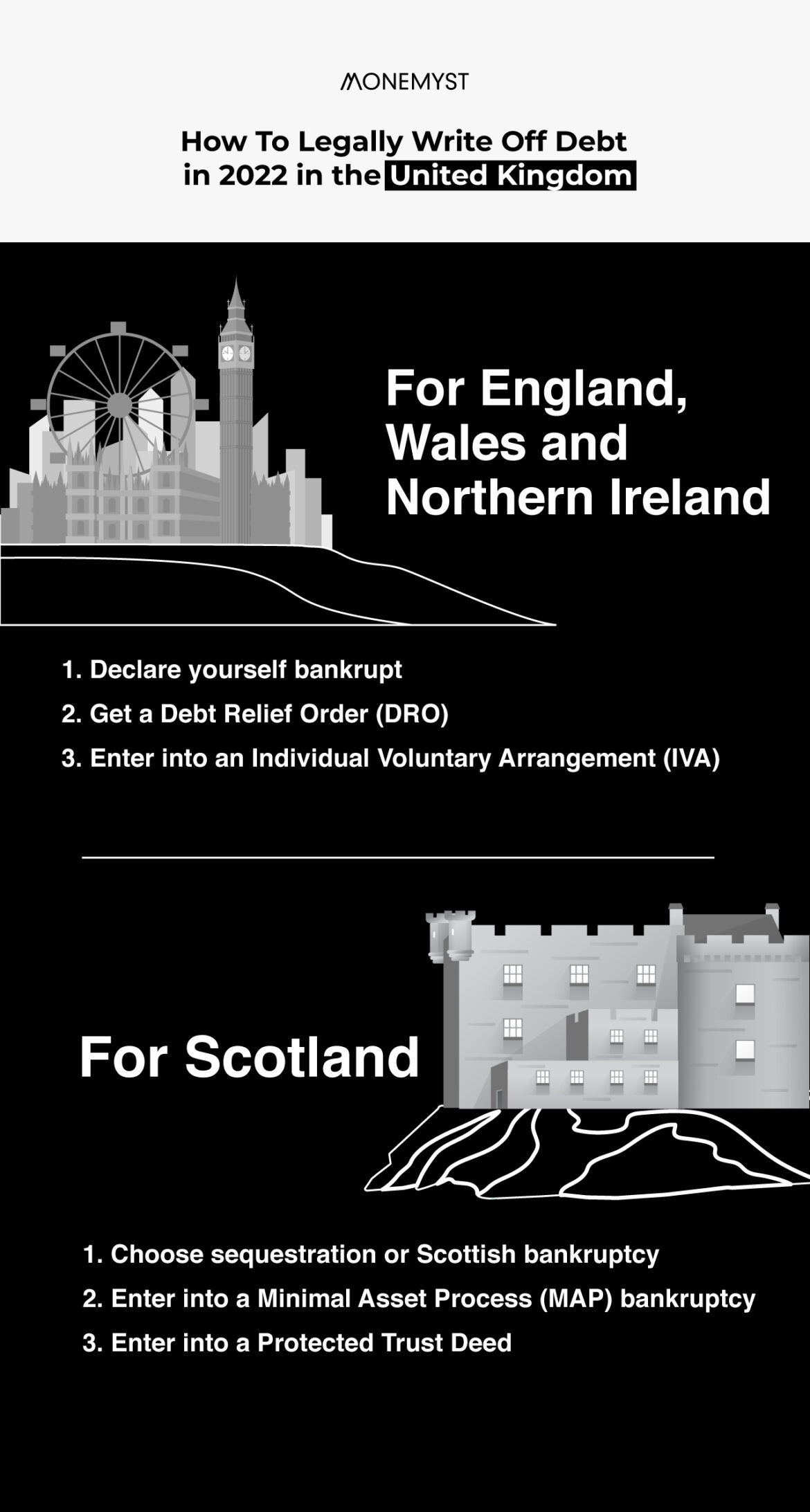

Another option is to file for bankruptcy. While this is not always the best solution, it can be a viable option if you have a serious medical condition. Many individuals with a terminal illness will be unable to work, making it unlikely that the debt will be paid off. Additionally, a bankruptcy may be a suitable solution for those who have accumulated large sums of debts.

How to Ask a Creditor to Write Off Debt was first seen on Help with My Debt