Getting Into Council Tax Arrears

Getting into Council Tax arrears can be a frustrating situation. If you are worried that you are going to be unable to pay your council tax bill, you should contact the local authority as soon as possible. You should also seek debt advice if you are in any doubt.

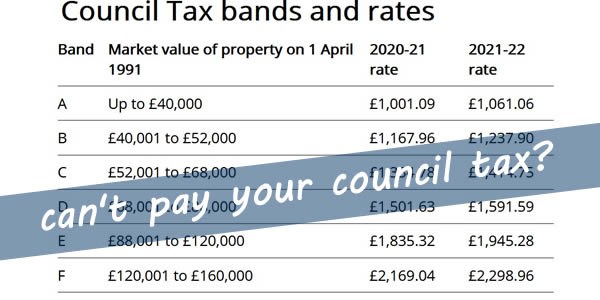

The amount you owe to the council is based on the value of your home, and your tax band. Depending on how much you owe, you can apply to the court for a reduction. The council may also write off the debt depending on how you repay the debt. In some circumstances, council tax arrears can be written off completely. If you are unable to repay the debt, you may also be able to apply for a County Court Judgment (CCJ) to stop the council from taking legal action against you. This will also stop any interest from being charged on the debt.

You should always try to pay your council tax bill in full before getting into council tax arrears. If you do not pay your council tax bill in full, you will be liable for a 10% penalty. This can add hundreds of pounds to your bill. The penalty will not apply if you pay the debt in full, or you pay it in monthly instalments. In addition, you may be liable for a bailiff’s fee.

It is a criminal offence to fail to respond to a summons. If you fail to respond to a summons, the council can apply for a Liability Order, which allows the council to take further action against you. You will also have to pay the court costs associated with the summons. It is also a criminal offence to fail to provide the council with information about your assets and income.

You may be liable for the council’s bill if you are living in a property jointly with someone else. You may also be liable for the bill if you have moved home or are on low income. The council will send out reminders about payments that you are due to make, and these will be displayed on your My Account. If you fail to respond to reminders, you will lose your right to pay by instalments. If you fail to pay the bill in full or by instalments, you will be issued with a final notice letter, which will give you 14 days to pay the full yearly bill.

Generally, councils want to collect council tax arrears as soon as possible. You should work out an affordable repayment plan, and discuss it with the council. You can ask the council for a special payment arrangement or to spread the costs over a longer period. The council may be able to offer you a more affordable repayment plan, or it may refuse the offer. However, if you do not feel comfortable dealing with the council, you can contact your local debt advice service.

If you do not pay your council tax in full within seven days of receiving a summons, the council can take you to court. The council will then apply to the court for a Liability Order, which gives the council further powers to recover money from you. The court will then issue you with a summons and ask you to appear at court. If you do not appear at court, you will be sent a summons to appear in court, and you will have to pay the full amount plus the court costs. The court can also issue an arrest warrant.

Getting Into Council Tax Arrears was first seen on Apply for an IVA