Debt Consolidation – How to Find the Right Debt Consolidation Strategy

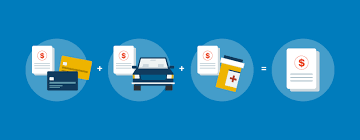

Taking out a debt consolidation loan is a way to get a cheaper interest rate on your debt. Debt consolidation also helps you pay off your debts more quickly and easier. If you have a large amount of debt, this can make your monthly payments more manageable. Debt consolidation can also help you avoid late payment fees and collection calls.

Debt consolidation can be done on your own or with the help of a credit counseling agency. The right consolidation strategy depends on how much debt you need to pay off, your credit rating and your spending habits. If you are unable to make the payments on your debt, you may want to consider negotiating with your creditors. You can also try to get a new loan product that offers better terms and lower payments.

Debt consolidation loans can be obtained from any financial institution. They can also be obtained through nonprofit credit counseling agencies. These organizations offer advice, information and a recommendation on which debt consolidation program will work best for you. Credit counseling agencies can also access your debt information to help you make informed decisions.

To find the best debt consolidation strategy, you should first take a look at your spending habits. Make a list of the debts you owe. Then, create a budget. This will give you an idea of how much you can afford to spend each month on debt. You may find that reducing your spending can help you get out of debt quicker.

In addition to making a budget, you should also consider negotiating with your creditors. Credit card companies often charge higher rates for late payments. They also do not usually sue debtors. You can use debt settlement or credit counseling services to negotiate with your creditors. These services can help you get out of debt faster by lowering your interest rates and lowering the number of creditors you owe money to.

If you have bad credit, you may be able to qualify for a debt consolidation loan. However, you may also be able to get a higher APR than you would if you had good credit. While the benefits of debt consolidation may be significant, you should not assume that it is a good idea for you. If you are a risky borrower, you may want to wait to consolidate your debt.

You should also make sure that the loan you choose offers a lower interest rate. Having a lower interest rate will save you money. But, if you consolidate your debts at a higher rate, you may end up paying more in the long run. Also, debt consolidation loans usually have a prepayment penalty. This means you may have to pay off the loan earlier than you would like.

Finally, make sure that the debt consolidation program you choose will save you money. You can find low interest credit cards from banks and low-interest credit cards from a credit card company. You can also consider a balance-transfer credit card. This allows you to concentrate your debts on one credit card.

Debt Consolidation – How to Find the Right Debt Consolidation Strategy was first seen on Help with My Debt