Debt Management – Why You Should Consider Debt Management

Whether you’re in need of debt relief or simply looking for a debt management program, there are several reasons to consider a debt management program. These programs allow you to pay off debt without having to apply for new credit. In addition, many debt management programs don’t affect your credit report. In fact, your credit score can even improve while you’re in debt management.

Debt management plans help you pay off your debts in three to five years by working directly with your creditors. These programs can even waive finance charges or collection calls. By repaying your debts in full, you’ll be able to reestablish your credit history. A certified credit counselor can also help you set up a budget and show you where to cut costs.

Debt reduction strategies vary depending on your personal situation and the type of debt you owe. Some can be more beneficial than others. For example, if you owe a lot of money on a home loan, you can reduce the payments by selling it. Or, you could buy a new house.

After establishing your plan, the counselor will contact your creditors and negotiate lower interest rates and fees with them. If your credit score is good, your creditors may agree to a plan that allows you to make a single payment monthly. In most cases, these plans last between three and five years, and you can usually save a significant amount of money in the long run. A debt management plan may cost a one-time setup fee and a monthly fee. These fees vary by state but are usually less than $50 a month.

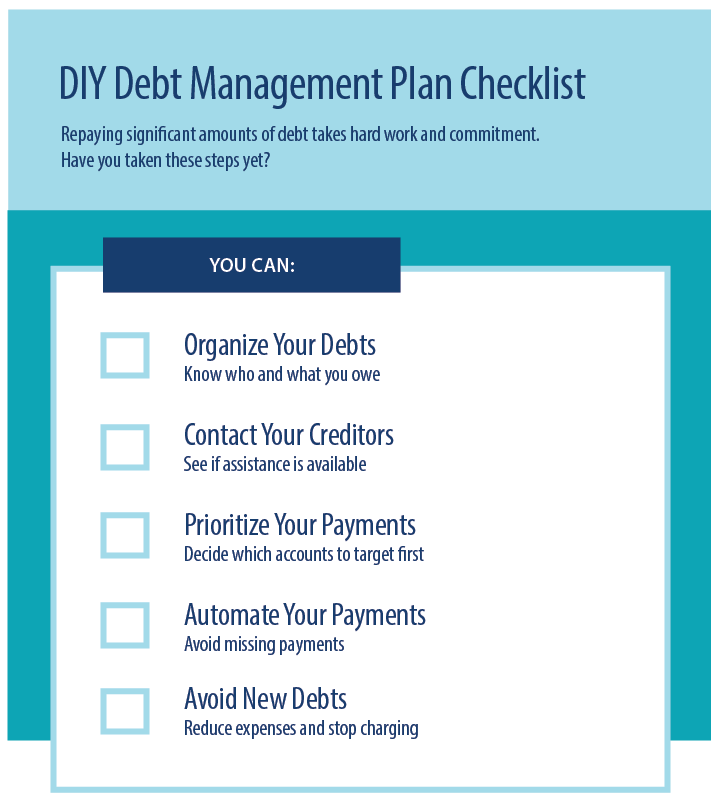

Debt management plans offer many benefits and can be an excellent way to stay on top of your finances. Setting a monthly budget and prioritizing your needs can help you stay on track with your debt. A debt management plan can also help you negotiate with your creditors, reduce interest rates, and even close an account. If you’re not sure whether to use a credit counseling service, try checking the National Foundation of Credit Counseling to find local counselors. When choosing a credit counselor, read their reviews and understand any fees they may have.

Debt management plans are not for everyone, and some people need different payment plans. For example, people with unsecured debts may find that they can’t use the same plan for all their debts. Some people also find that a debt management plan limits the amount of credit they have. This isn’t a good solution if you have a secured loan or a mortgage.

Another option is to seek debt management services from a nonprofit credit counseling agency. These agencies offer debt management programs, which are designed to lower the interest rate on credit cards to around 8%. This makes payments more affordable, and you’ll be able to pay off your debt in three to five years. A nonprofit credit counseling agency will help you find the right plan for your situation. They will also help you create a budget so that you can pay off your debts in a more manageable amount.

Debt Management – Why You Should Consider Debt Management was first seen on Debt Worries