Bankruptcy – What You Should Know Before Filing Bankruptcy

Bankruptcy can be a very helpful and legal way to get out of debt. It allows you to get a fresh financial start, but there are a number of things to know before you file for bankruptcy.

The process starts when you file a petition with a court. The court will then review your finances and decide whether to discharge your debts. If the court rules in your favor, your creditors are prohibited from trying to collect from you. They cannot garnish your wages or repossess your property.

You will need to provide details of all your debts and assets. The court will also make a decision on how to pay your creditors. If your creditors are not satisfied with your payment plan, the court may decide to discharge your debts.

Once you have been granted a discharge, your credit score will begin to recover. You should pay your bills on time after a discharge, but not use more credit than you need.

If you are having trouble making payments, you should seek out a professional financial counsellor. They can help you devise a budget to work towards reestablishing your credit. They can also offer free financial counselling.

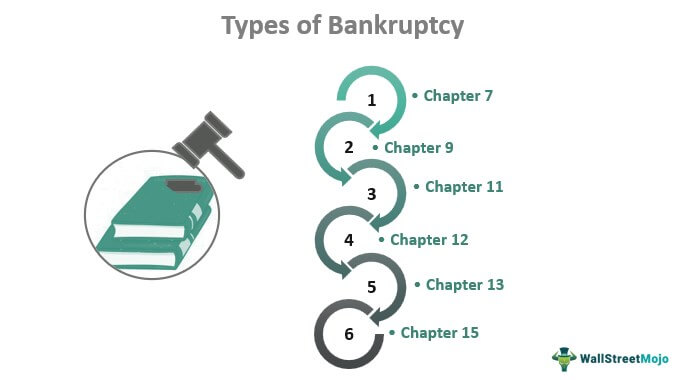

If you are struggling with multiple debts, you should consider filing a chapter 13 bankruptcy. This type of bankruptcy restructures your debt into a three to five year repayment plan. You will have to continue to pay your mortgage, but your other creditors will be paid a portion of your income.

You can also get help with your debt through the National Debt Helpline. They can give you information on other support services. It is advisable to seek advice from a lawyer before filing for bankruptcy. A bankruptcy will stay on your credit report for seven to ten years. This can affect your ability to get a loan, a mortgage, or a credit card.

The court can choose to sell some of your assets. Your car will also be seized if you do not have enough equity. However, if you do have a home, you can keep it by reaffirming your loan.

You should also keep a record of your remaining loans and spending habits. This can help you to rebuild your credit if you do not use more than you need to.

You can learn more about your options by visiting the AFSA website. The site includes a Bankruptcy Form that you can fill out. The form is available in several languages, including English, French, Spanish, and Italian. It will help you understand the consequences of bankruptcy, how to keep your possessions, and how to protect your financial future.

Once you have filed for bankruptcy, you should follow the directions of the bankruptcy trustee. This person will be responsible for monitoring your repayment plan. He or she will also ensure that you are making the proper payments to your creditors.

There are many negative aspects to filing for bankruptcy. You should only do so if you have exhausted other options for paying your debts.

Bankruptcy – What You Should Know Before Filing Bankruptcy was first seen on Debt Worries