What Is a Trust Deed?

A trust deed is a legal instrument in real estate that creates a security interest in real property. It transfers the legal title to a trustee, who holds the property as security for a loan. There are several types of trust deeds, each with different purposes. For instance, a trust can be used to transfer a home equity line of credit to a friend or relative.

A trust deed is the most common method of financing a real estate purchase in California and other states. It transfers the property title to a trustee, often a title company, who holds it as security for the loan. The property is then returned to the borrower when the loan is repaid. The trustee does not become involved in the arrangement until the borrower defaults. The trustee may then sell the property in a nonjudicial foreclosure, which can take years.

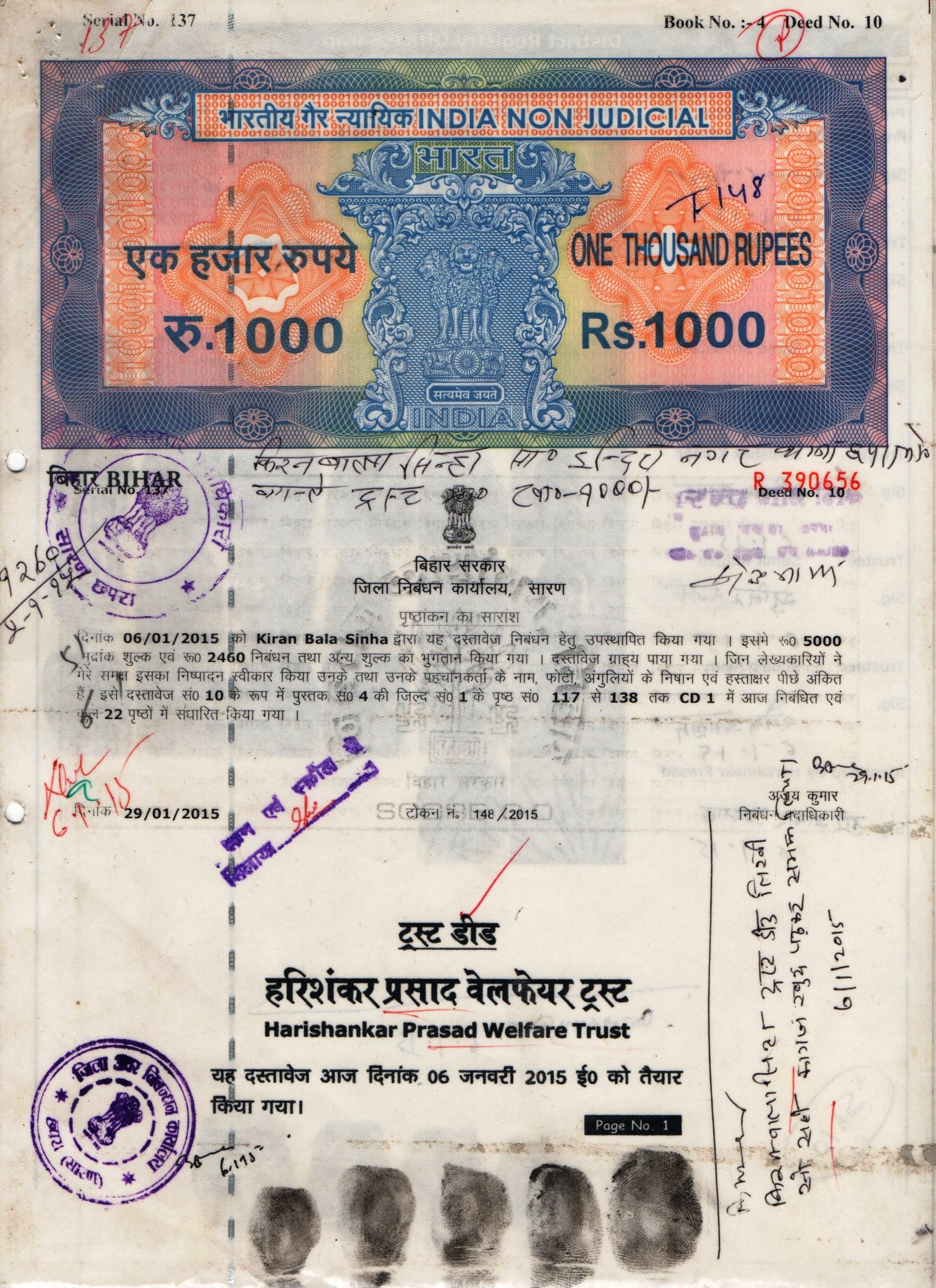

A trust deed is a legal document that outlines the terms and conditions of the home purchase. It also provides legal protections for the lender. The trust deed must be signed by the borrower and lender before it can be effective. A trust deed is recorded with the county clerk & recorder’s office. In some jurisdictions, borrowers are allowed to obtain second mortgages and third mortgages. These deeds can make similar transfers to additional trustees.

Most investors rely on a broker to present trust deed opportunities. Brokers also perform due diligence on their behalf. They will guide their clients through the process and offer legal advice. A trust deed is not a perfect investment, but it does offer advantages that may make it a smart option.

A trust deed can help people avoid bankruptcy and allow them to keep their property. However, it’s essential that you have a sufficient disposable income to pay off your debts in the short term. Most people can pay off their debts in four years or less if they use a trust deed.

A trust deed is a legal document that must be properly drafted and recorded. It is recorded with the recorder of titles in the county where the real estate is located. There are also state laws that govern trust deeds. A poorly drafted trust deed can result in a number of unwanted problems. A real estate lawyer can provide valuable advice on how to draft a trust deed.

A trust deed is similar to a mortgage, except that it contains an extra party called the trustee. Both documents help the lender secure a loan. However, the primary difference between the two documents is how they handle defaults on payments. With a mortgage, the lender must take the property to court to foreclose, while with a trust deed, the trustee can pursue the foreclosure process without having to go through the courts.

A trust deed is similar to a mortgage in many ways. However, it adds a third party who will hold title to the property for the duration of the loan. It is a legal agreement between the lender and borrower that holds the property in trust until the loan is repaid or the borrower defaults.

What Is a Trust Deed? was first seen on Pathway IT