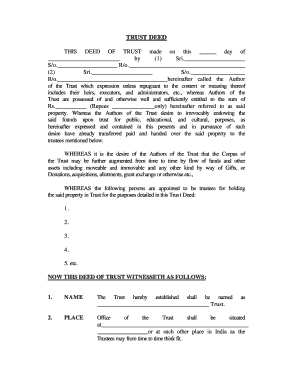

What Is a Trust Deed?

A trust deed is a legal document used to transfer a security interest in real property. It transfers legal title to the property to a third party, called a trustee, who holds it as security for a loan. These deeds are commonly used by lenders for a variety of reasons, from loan repayment to estate planning.

Today, trust deeds are not as common as they were, but they are still very common in many states. In fact, 20 states require property buyers to use them in lieu of mortgages. These states include Alaska, California, Idaho, Illinois, Mississippi, North Carolina, Oklahoma, and Tennessee. In addition to being used for mortgage financing, a trust deed can be used for many other purposes, including as collateral or to secure the performance of a contract.

A trust deed transfers the title of property to a trustee, usually a title company, which holds the property in trust for the borrower. A power-of-sale clause is also typically included in trust deeds. This clause allows the trustee to sell a property if the borrower fails to make their payments.

Investing in trust deeds can be a lucrative way to make a profit while still maintaining a low risk profile. In some cases, the minimum investment for a trust deed is as low as $10,000, although the amount may vary depending on the broker. A trust deed can yield a higher yield than a direct investment in real estate, though banks are hesitant to lend to them due to the recent credit crisis.

When deciding whether to set up a trust deed, it is important to consider your debts and income. In general, a trust deed lasts four years, and the trustees will be able to apply to make you bankrupt within that time. During this period, most of your debts will be written off and the borrower will no longer be liable for paying the rest.

A trust deed works similarly to a mortgage in that it places the title of property in the hands of a third party. As a result, trust deeds are a more affordable alternative to a mortgage in some states. You can sell the property to another lender if you want, but make sure to check with your lender before making the transaction.

A trust deed has three parties: the borrower, the lender, and the trustee. The lender holds the lien against the property, and the trustee holds the property title until the loan is fully paid. The trustee is typically an escrow company. If the borrower defaults on the loan, the trustee will sell the property to recover the money.

In some cases, a trust deed can be used to save a home. A trust deed is a legal document that can help borrowers avoid foreclosure by ensuring that they have sufficient time to reclaim the property. Most states allow the use of a trust deed, while some states do not. A trust deed can also be used in conjunction with a mortgage in some circumstances.

What Is a Trust Deed? was first seen on Pathway IT