What is a Trust Deed?

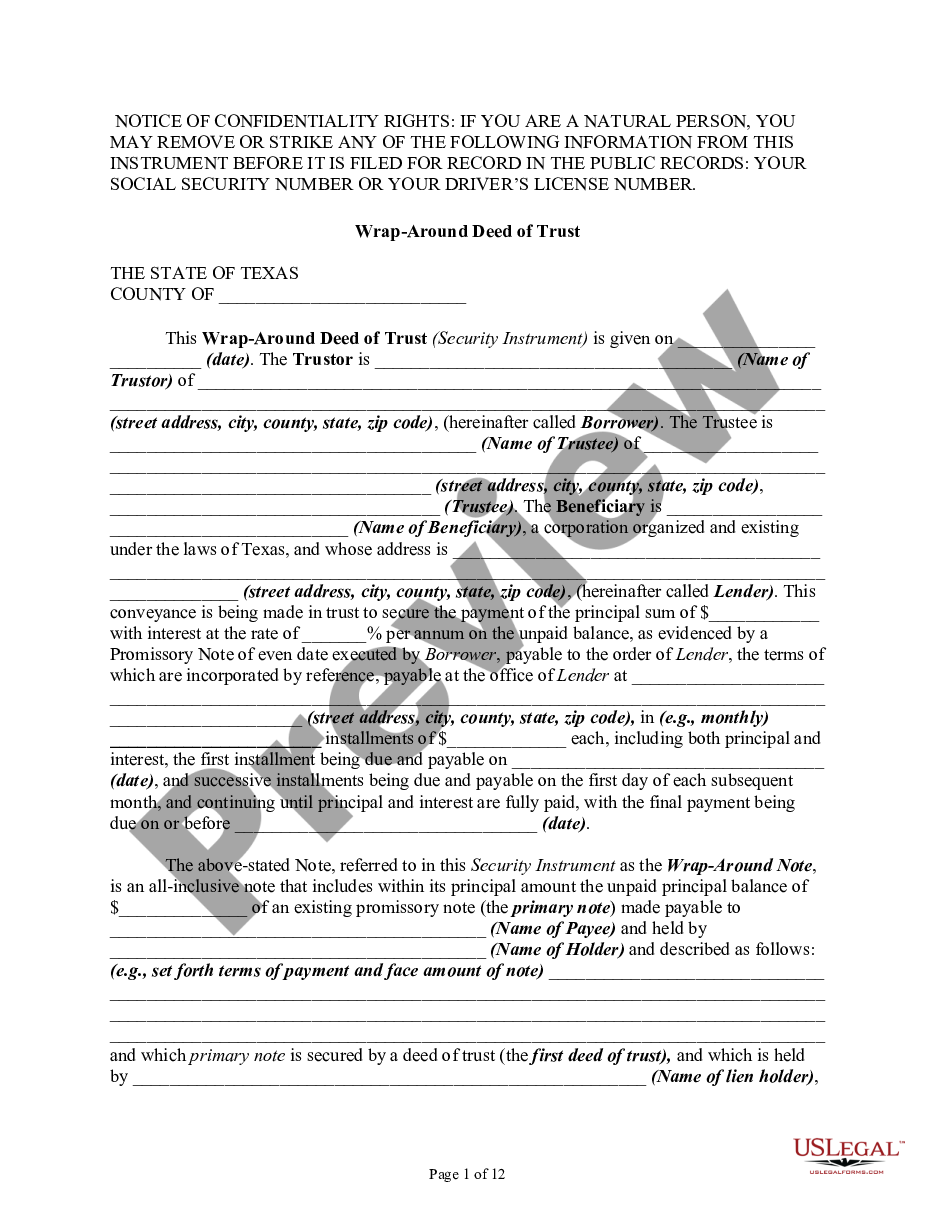

A trust deed is a legal document that creates a security interest in real estate. It transfers legal title to the property from the owner to a trustee, who holds the property as collateral for a loan. It is one of the most common types of deeds in the United States.

In most states, trust deeds are used for purchasing real estate. A borrower transfers the title to a trustee, usually a title company. The trustee holds title to the property as security for a loan, and the borrower regains ownership when the loan is paid off. However, unlike a conventional mortgage, the trustee is not involved in the arrangement unless the borrower defaults on the loan and the trustee is able to sell the property in a nonjudicial foreclosure.

Investing in trust deeds generally offers an attractive yield, with low risk and a long payback period. The loan is typically issued to borrowers who may not qualify for bank lending, and the investor receives a fixed, monthly return on the investment. The loan will mature when the investment is repaid, so it can be a good way to earn passive income.

A trust deed has several key parts, including the initial loan amount that the lender and trust beneficiary agree to use as collateral. The loan amount is generally the agreed-upon purchase price of the home, minus any down payment. Because this amount must be paid back, the borrower has a clear idea of how much money they will be able to borrow.

Besides using a loan as collateral, trust deeds are also used to secure real estate loans. While they are still not legal in every state, trust deeds are often used as an alternative to mortgages. They are still used in 20 states. They are a legal way to protect both the lender and the borrower.

A trust deed is similar to a mortgage, in that they create liens on landed properties. The differences between the two types of deeds are largely in their terms. Talkov Law is well versed in the intricacies of both. The difference between a mortgage and a trust deed is the trustee. If a borrower defaults on their payments, the trustee will take possession of the property and sell it to cover the loan balance.

A trust deed is similar to a mortgage but adds a neutral third party. The Trustee will hold the title to the property until the loan is fully paid. The loan will be recorded as a public record in the county clerk’s office. In some states, a trust deed may be used instead of a mortgage.

What is a Trust Deed? was first seen on Pathway IT