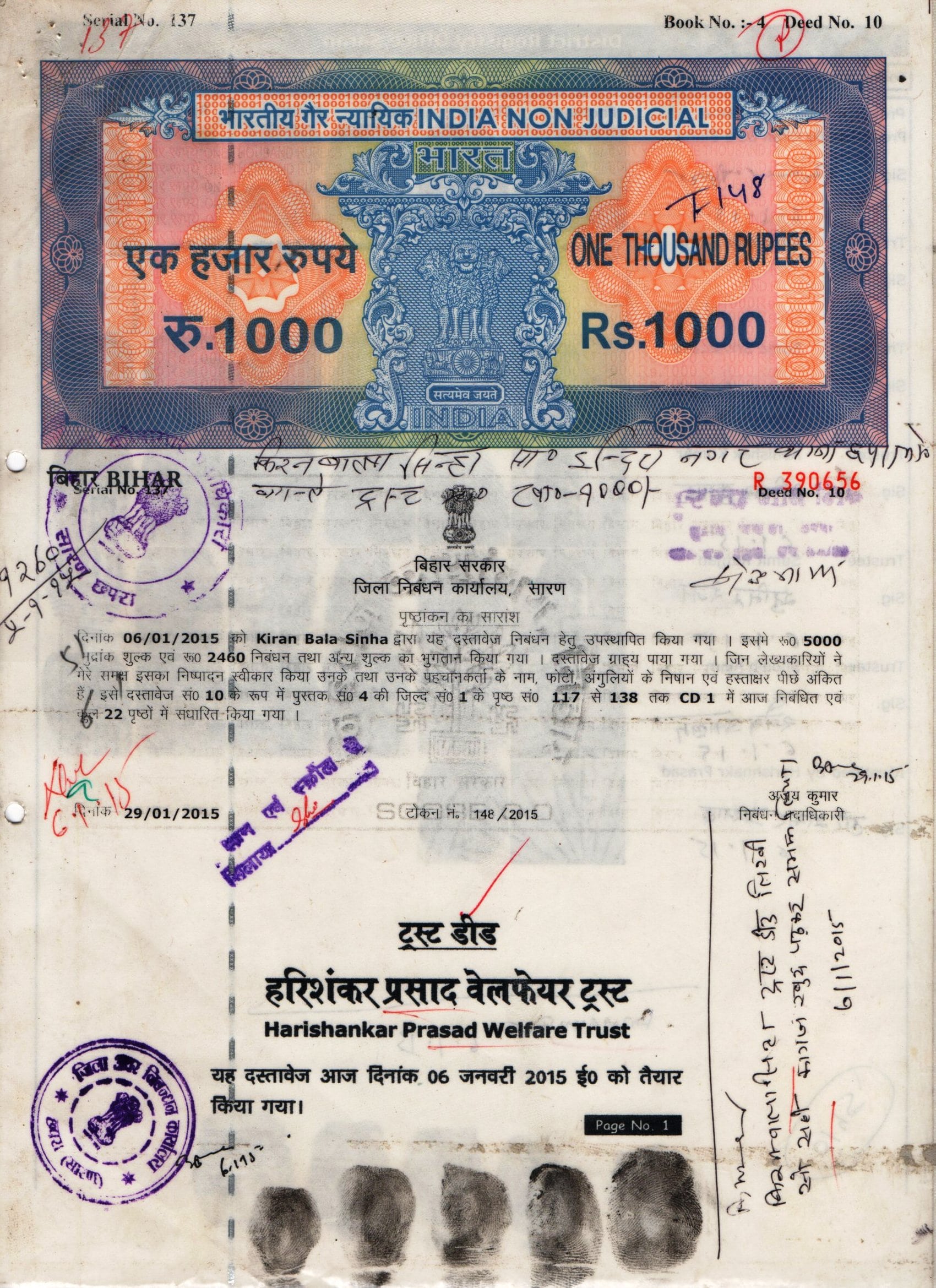

What Is a Trust Deed?

A trust deed is a legal document that creates a security interest in real property. It transfers legal title to a trustee who holds the property as security for a loan. It is a popular method of transferring real estate. However, there are some things you should keep in mind before using a trust deed.

A trust deed has several benefits. The first is that it can prevent creditors from taking action against you. It can last for up to 4 years and can also protect your assets and your home from being sold to pay off your creditors. It is a good idea to check all the details of the trust deed before signing it.

Another advantage is the fact that a trust deed is not insured by the FDIC. However, it is still a good idea to work with an experienced broker to ensure that your trust deed investment will work out. A broker will be able to advise you on the best course of action, and will help you to avoid any conflicts of interest.

Alternatively, a lender may use a deed of trust instead of a mortgage. This type of real estate loan is similar to a home mortgage in that it requires the property to be held in a trustee’s name. The trustee will hold the title until the loan is fully paid.

A trust deed is usually recorded in public records. They are recorded with the county recorder in the county where the real estate is located. It will contain a detailed description of the property and the trustor’s rights and responsibilities. The deed will also specify if the trustor has the ability to exercise those rights.

While trust deeds and mortgages serve similar purposes, they differ in terms of their terms. A mortgage, by contrast, will allow the lender to repossess a property if it does not repay its loan. In a trust deed, there are three parties to the transaction – the borrower, the trustee, and the mortgagee.

What Is a Trust Deed? was first seen on Pathway IT