Investing in Trust Deeds

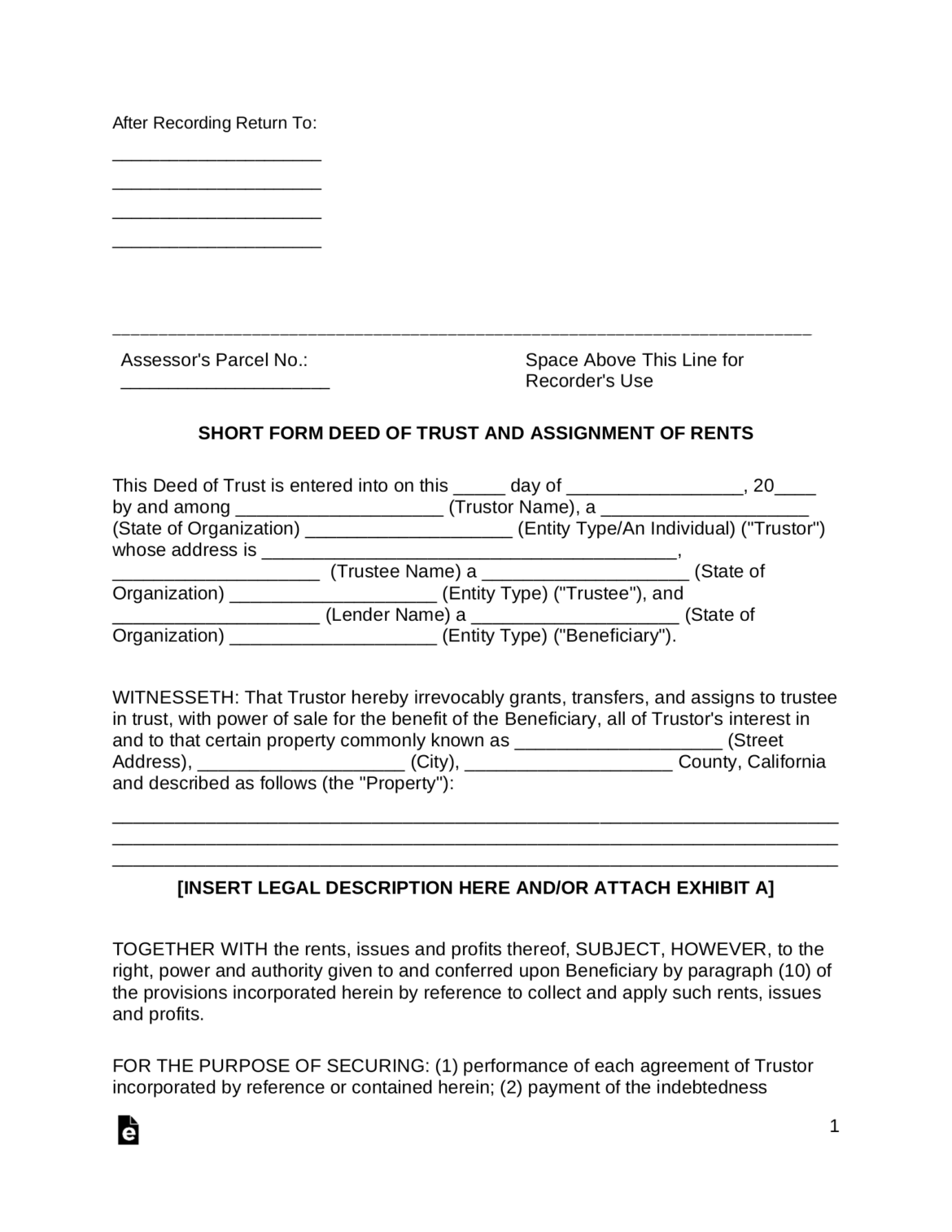

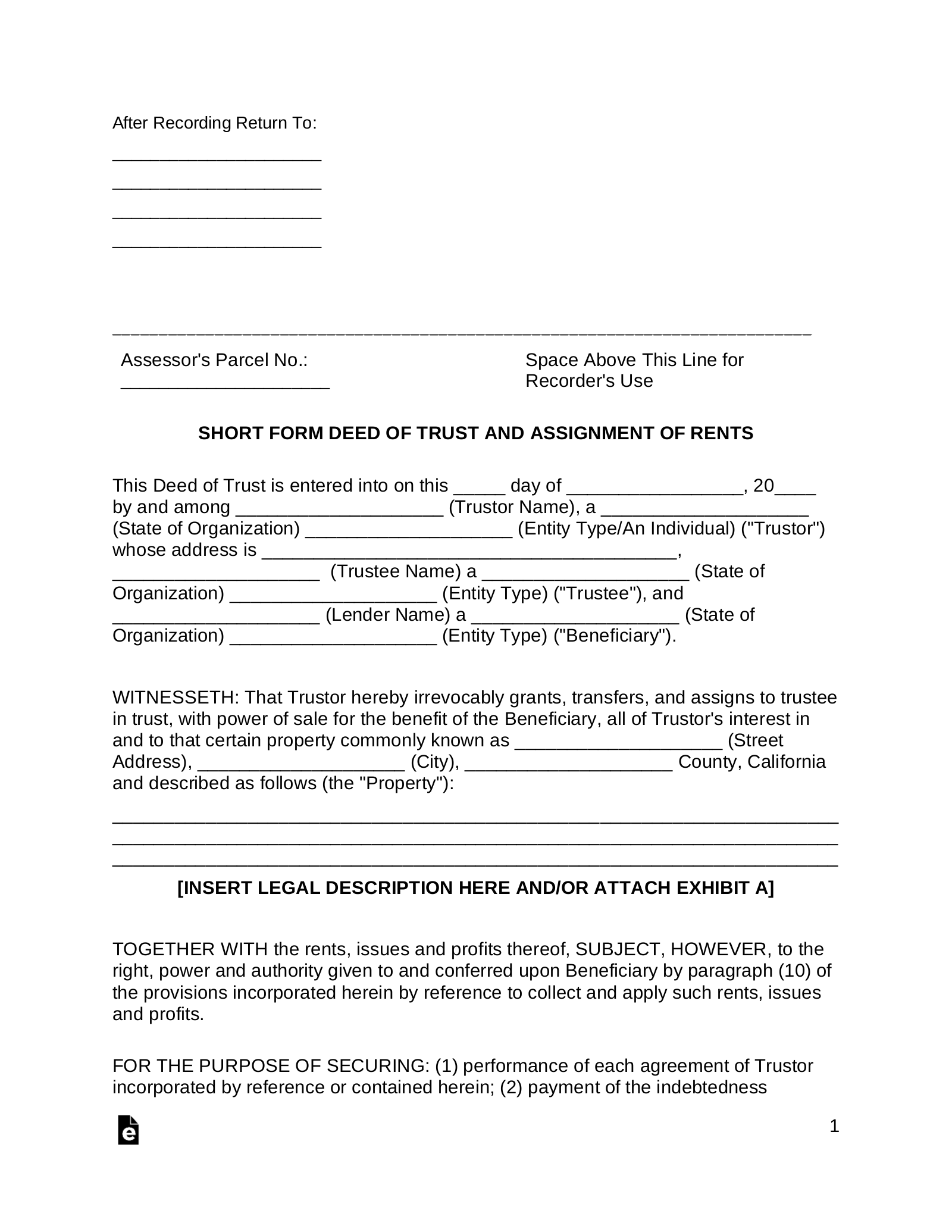

In states such as California, Alaska, Idaho, Montana, and Texas, a trust deed can be used to transfer title to real estate. The trust holds title to the property until the loan is paid off, but the borrower remains an “equity owner” of the property, allowing them to enjoy homeowner benefits and gain equity. Another party protected by the deed is the beneficiary, who is generally a lender. However, an individual can also be named as a beneficiary.

Unlike a mortgage, a trust deed gives the trustee the authority to sell or transfer the property. Foreclosure occurs when the borrower fails to make scheduled payments or fails to pay the loan. The property is then transferred back to the lender. The lender benefits from this because they no longer have to deal with an equity stake. The borrower’s credit score can rise if the borrower meets his payments on time.

The returns of trust deed investing can be attractive, but you should be aware that there are risks. You cannot sell or liquidate your investment until the loan is paid off. Moreover, you must be willing to commit for the term of the loan. If you cannot repay the loan, the property will remain in the trust of the corporate trustee. This arrangement can be risky, so be sure to do your research and learn about the sector before investing.

The process for foreclosing a trust deed starts with recording a “Notice of Default.” A lender can then give the borrower 90 days to remedy the situation. At the end of the 90-day period, the borrower must repay any outstanding amounts. If they fail to do so, the property must be sold to avoid foreclosure. In this way, the trust deed process can be faster than a judicial process, minimizing the risks of trust deed investments.

In addition to the lender’s benefit, a trust deed also makes it easier for the bank to foreclose on a property. Because there is no judicial process involved, foreclosure occurs faster. Nonetheless, buyers cannot opt for a mortgage in lieu of a deed of trust, so it’s important to be aware of all the terms before signing. So, it’s important to have a lawyer review the deed of trust to make sure the property purchase goes as smoothly as possible.

When a borrower wants to buy real estate, they must consider a trust deed as an option. A trust deed is a contract between the borrower and lender. It transfers legal title to real estate to a third party (called the trustee) who holds it in trust until the loan is fully paid. Although this arrangement is less common than a mortgage, it’s still legal in 20 U.S. states.

A trust deed is similar to a mortgage, but has several important differences. Unlike a mortgage, a trust deed is an agreement between the borrower, a trustee, and the lender. In both cases, a third party, or trustee, holds the property title until the loan is fully paid. The trustee has the authority to foreclose on the property, which means that if a borrower doesn’t repay the loan, the trustee has the power to seize the property.

Investing in Trust Deeds was first seen on Pathway IT