Debt Help – How an IVA Works

An IVA is a debt solution where your creditors agree to work with you to restructure your debts. Your creditors have to approve the plan in order for it to take effect, and they usually send their votes to your IP (independent payment adviser). Once the creditors approve your IVA, your IP will negotiate with your lenders. If you are unsure of how the process works, you can call the National Debtline for independent debt advice.

Secured loan IVAs are often the best option for people who owe large amounts of money and wish to keep their homes. While this solution is not suitable for everyone, it is ideal for those with high levels of debt and a high risk of repossession. It is also an excellent choice if you have equity in your home that you can use as collateral. In addition, secured loans are usually cheaper than unsecured loans, which helps you to pay them off more easily.

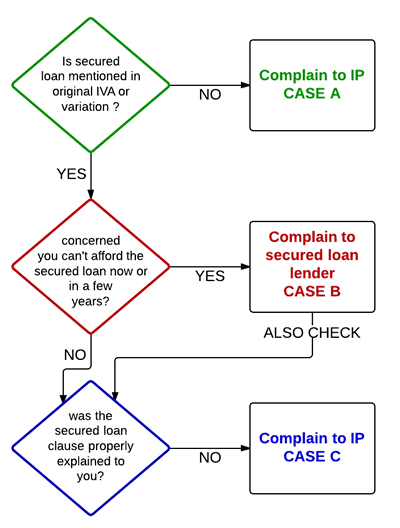

Secured loan IVAs can be a good choice for people who have taken out a loan from a bank or other lender, but you should consider your circumstances before you make your final decision. In some cases, you can include your secured loan as an unsecured debt in an IVA. The payment on a secured loan is usually included in your expenditure calculations, so you must be sure you can afford it.

If you have equity in your home, it is possible to get an equity release loan from an IVA. However, in some cases, you might find it difficult to find a lender that offers this option. However, it is important to remember that an IVA should be fair for all parties, including your creditors. In the current economic climate, it is difficult to sell your home and obtain a secured loan. For this reason, it is recommended that you get advice from a professional and discuss your situation with your IP. Otherwise, you may find yourself bankrupt.

If you have equity in your home, you may not be able to obtain a secured loan or mortgage. You may be asked to make 12 extra payments to your creditors in lieu of selling your home or getting a secured loan. This will prevent you from having to investigate remortgaging or taking out a new loan to cover the debts. However, it is important to note that you cannot take out a new secured loan or mortgage when you’re in an IVA.

An IVA is a good debt solution for many people, but it is not for everyone. It is generally only suitable for people with a high balance of debt and more than three creditors. Also, you should make sure that you can afford to pay all your loans. Another great feature of an IVA is that it allows you to keep some of your essential assets. The key is to make sure you have the money to make these payments and to ensure that you don’t lose your home.

Debt Help – How an IVA Works was first seen on Pathway IT