What Is Equita?

Founded in 1973, Equita is a company that offers debt recovery services to local authorities. It has been in the debt recovery industry for over a century, and currently employs over 1000 people. Equita is part of the Capita group of companies, which specialises in outsourcing solutions, investment banking, and professional services.

Equita has offices in Northampton, England, which is its registered office address. In addition to that, Equita has offices in Manchester and Birmingham. These offices are in addition to the many other offices across the UK. These offices provide Equita with the necessary expertise to handle millions of customer contacts per year. In addition to that, Equita also has a team of 350 debt enforcement officers who are ready to assist with any debt issues that may arise.

In addition to the services provided by Equita, the group also offers financial advice and research. Equita is also able to offer capital raising solutions and alternative investment solutions. It is able to offer debt advice and debt payment plans to debtors. This helps ensure that the money is paid and the debtor is able to make payments.

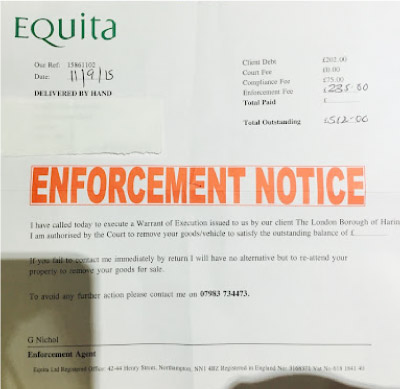

In addition to that, Equita has the ability to seize possessions to help pay the debt. These possessions can include a home, or the goods in the home. Equita can also use bailiffs to take possession of these goods and sell them to help pay the debt. However, these are only able to be used for specific debts.

If a debt is not paid, a local authority can issue a County Court Judgement (CCJ). This CCJ will be placed on your credit rating for six years. It will also make securing financing more difficult. It is important to contact your local authority as soon as possible after being issued with a CCJ. It is also important to make a payment plan with Equita so that they can collect the debt.

When an unpaid debt is issued, Equita sends letters to the debtor requesting that they pay the debt within seven days. In addition to this, Equita will make phone calls and send text messages to the debtor. Depending on the type of debt that is issued, Equita may even send a bailiff to the debtor’s home. These agents will try to collect the debt, but if they are unable to do so, the debt may be issued with a CCJ.

In addition to that, Equita can also take money from the debtor’s wages or benefits. If the debt is owed to a private company, it may be able to collect it through Equita’s business rates, taxation receipts, or parking penalty charges. The company can also help to collect unpaid rent arrears in communities throughout England.

In addition to that, Equita also works with debtors to offer debt advice and payment plans. The company has a network of offices across the UK, allowing them to quickly and efficiently collect the debt.

Equita has also been in the debt collection business for a long time. It is able to spot problems within the market and offers clients uncompromised advice and services. It also works with hundreds of local authorities to help recover debts.

What Is Equita? was first seen on Help with My Debt