Marston Holdings – How to Avoid a Collection Call From Marston Holdings

If you are unable to pay a credit card bill, you may find yourself receiving a call from Marston Holdings. This company is a major judicial services group with a reputation for enforcing court orders. The company has a good customer service department and uses technology to track debtors. Here are some tips that can help you avoid getting a collection call:

Marston Holdings is a large judicial services group

Marston Holdings is a leading judicial services group in the UK, with over 2,000 employees and self-employed agents. This group helps individuals, businesses, and government entities recover over PS300 million every year in debt. Its services include court enforcement, debt solutions, and individual voluntary arrangements. Read on to discover more about this large judicial services group. Let’s face it – we all need a little help sometimes.

The Marston Group is the UK’s largest judicial services group. With over 1,200 employees and clients throughout the UK, the company acts on behalf of taxpayers to recover unpaid fines and arrears. These include unpaid child support, council tax, congestion charges, bus lane contraventions, and unpaid invoices from small businesses. According to CB Insights, the group is the leading judicial services company in the UK.

It has a reputation for enforcing court orders

Marston Holdings is a UK-based judicial services company that provides debt collection, transportation, and enforcement services. Operating nationwide, the company claims to handle over 1.5 million claims a year and has more than 1,000 enforcement and customer care staff. The company has been in business for over 125 years, and has a proven track record of success. If you are considering using a debt collection agency to enforce your court orders, here are some things to keep in mind.

First of all, you must understand what a bailiff will do. A bailiff will do what is necessary to reclaim your property. You can refuse to hand over your property to the Marston Group, but you will have to pay the bailiffs’ fees. If you refuse to surrender your property, you could risk losing your valuable items. Fortunately, there are a number of consumer debt advice organisations that can provide you with more information on your rights and options. Regardless of your situation, it is important to avoid escalating debts by understanding your rights.

It has a good customer service department

A good customer service department can go a long way in keeping a good relationship with a debt collection agency. Marston Holdings is no exception. Their employees are high court enforcement officers and have considerable authority over consumers. They can even use reasonable force to enter your home if you fail to pay a debt. However, it’s important to note that many consumers have complained about the inefficiency of the company’s customer service department.

Marston Holdings is a UK based judicial services group that has more than 2,000 employees and 500 clients. Their database processes over 1.5 million cases annually and they have won numerous awards in customer service and credit enforcement. Marston Holdings needed a way to reduce the costs of payment processing while improving the experience of their customers. They hired Key IVR to develop a system for customers to self-service their payment needs.

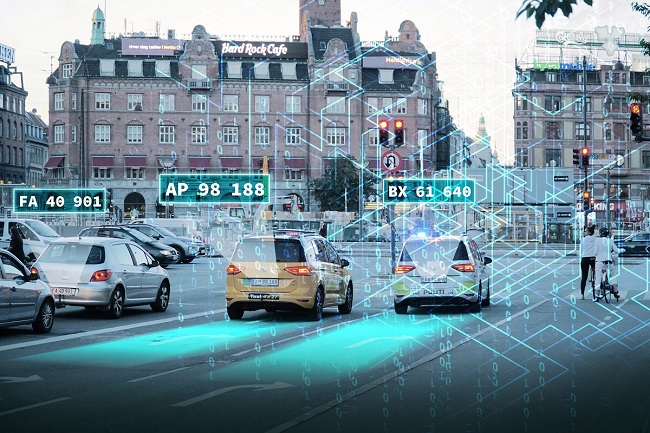

It uses technology to keep track of debtors

Debt collection agencies such as Marston Holdings are notorious for using crude tactics when trying to collect money from debtors. While these companies are regulated by the Ministry of Justice, their agents can be intimidating and unfair. Here are some tips for avoiding this company. Read on to learn more about your rights and how you can stop the collection efforts of Marston Holdings. The company uses technology to keep track of debtors.

To protect yourself against the collection efforts of Marston Holdings, it is important to make payments on time. While you may feel compelled to make repayments when you can’t afford it, there are several things you can do to avoid becoming a victim of debt collection. One way is to avoid falling behind on your debt by contacting the agency that sent you the collection letter. You can also use the DoNotPay website to get in touch with the company. This service is available free of charge.

It can seize assets

Marston Holdings has the power to seize your assets if you fail to repay your debts. In some cases, they can even repossess your vehicle. To recover your money, you should immediately pay off the debt if you want to keep your car. If you can’t pay your car loan, Marston Holdings will seize your car. They will use a sophisticated database to track you down and repossess your most valuable property.

The Marston Holdings enforcement agents can visit your home and repossess your assets. Even if you refuse to pay your debts, they will use your personal details to contact you and repossess your assets. To avoid this, you should contact your creditor and arrange a payment plan. Never ignore your debts. There are ways to get a payment plan that is affordable and will allow you to keep your property.

It cannot take everything you own

Although Marston Holdings can legally take everything you own if you fail to pay your debts, you must be aware that you cannot give up all your possessions. While Marston agents are allowed to sell certain items at auction, they cannot remove essential household items, such as bed sheets, fridges, medical equipment, or cookers. You can also contact a consumer debt advice organisation to find out more about your rights.

A Writ of Control is a legal document that gives enforcement officers from the high court the authority to repossess your assets and enter your property. Taking control of goods regulations apply to this process, and Marstons Holdings abide by them. These regulations state that bailiffs can only enter your property with reasonable force. You should also know that a bailiff cannot enter your property without your permission and without a court order.

Marston Holdings – How to Avoid a Collection Call From Marston Holdings was first seen on Help with My Debt