How to Eliminate Credit Card Debt

Paying interest on credit card debt eats away at savings for retirement, emergency funds, and down payments on a home. Your credit score is affected by your credit utilization ratio, which is your total debt divided by your available credit. Keeping your debt under 30 percent is the best way to keep your score healthy.

You can get help to manage your debts by following a few simple steps. Firstly, set aside a monthly amount to pay off your credit cards. Alternatively, try saving it for an emergency fund. If this doesn’t work, consider seeking free debt help. These services can advise you on different debt solutions and help you set up a repayment plan.

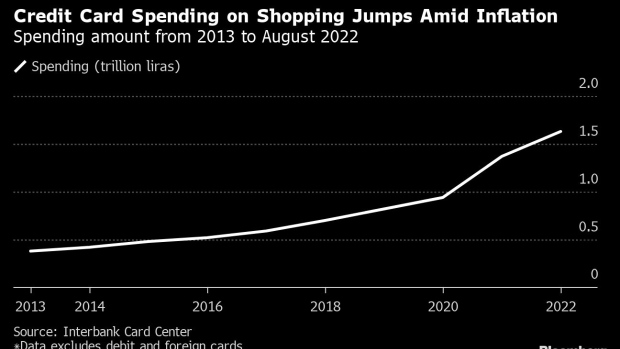

According to the Federal Reserve Bank of New York, Americans have a total credit card balance of $887 billion in the second quarter of 2022. This represents a $46 billion increase from the first quarter of 2022. In the last 20 years, credit card debt has increased by $100 billion. Credit card debt is a problem for many Americans and can be crippling for some families. It also adds a tremendous amount of stress to their lives.

Credit card companies profit by charging you interest on your balances. Unless you pay the full balance each month, you will accrue interest on the balance, resulting in a debt load that is greater than your income. The interest rate on your debts can change as the Fed adjusts its target interest rate. Keeping this in mind, it is important to remember that you should never charge more than you can afford to pay back each month.

There are many options for debt relief, including bankruptcy, debt consolidation, and low interest rates. These options vary from company to company, but many will provide low monthly payments or deferred payments. However, you must make sure that you don’t skip or reduce payments during the forbearance period. During this time, credit card companies may also offer reduced interest rates or waive late fees.

According to the Federal Reserve Bank of New York, Americans owe $887 billion on credit cards. This is a 13 percent increase from a year ago. Inflation is increasing at an alarming pace, and the average interest rate on credit card debt is at its highest level in 30 years. As a result, many are now paying more than they can afford.

In addition to the accrual of interest and penalties, a person’s credit score is damaged by non-payment of credit card debt. If this is not remedied, the credit card companies may sue him or her. Credit card companies may also charge additional fees and interest, which only adds to the debt burden.

The first step in debt relief is to contact the credit card companies and explain the situation to them. You can do this on your own or hire a debt management company. Many debt professionals claim to be able to negotiate a better deal than you can, so it’s worth asking about their services.

How to Eliminate Credit Card Debt was first seen on Help with My Debt