How to Deal With Council Tax Arrears

When someone falls into council tax arrears, the first thing they should do is talk to their local council. This will help the council to understand the situation and see if they can work out a suitable repayment plan. They will also be able to offer advice on how best to tackle the issue.

In most cases, councils want to see payments made within the current council tax year. If this is not possible, they may ask you to pay over several months or in instalments. You will then be issued with a bill for the amount due, plus any additional court costs. The bill will tell you when the payment is due, how much is due, and a reminder of the next payment.

A council will take legal action if you fail to pay a Council Tax bill. Although there is no fixed time period, the consequences can be quite severe. For example, your home could be seized to make up the balance, or you may be sentenced to prison.

Usually, the council will send you a letter to remind you that the debt is due. It will also tell you how to respond, and give you a time limit. However, this is not always the case. Sometimes, the council will try to seize money from your wages or benefits.

Before the council takes any action, they will usually send you two reminder letters. The first one explains the procedure, but you don’t need to take any action until the second reminder comes. Once you’ve received the initial notice, you have fourteen days to respond. Your response doesn’t have to be a full payment, but you should definitely try to pay up. Paying the full bill may be the only way to avoid further legal action.

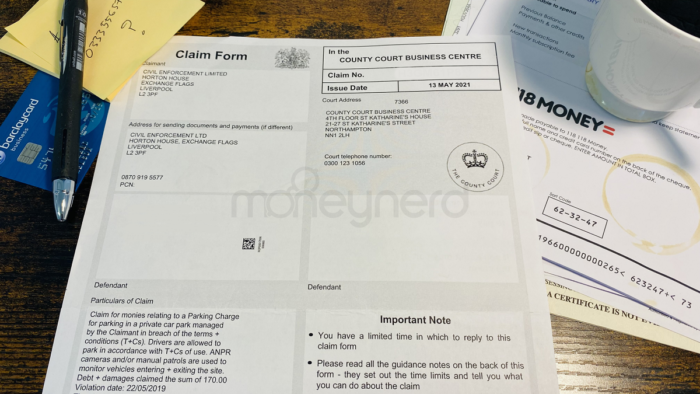

One of the most common actions a council takes against a debtor is to file a County Court Judgment, or CCJ. As a result, your name will no longer appear in the paper, but you’ll have to pay hundreds of pounds in court costs.

One of the most important things to remember is that failing to respond to a letter from a council is a criminal offence. Even if the council isn’t taking legal action, you should still contact your local Citizens Advice Bureau.

In the event that the council does take legal action, it will often apply for a liability order, which gives it more powers to recover the outstanding amount. It’s also possible for the debt to be written off, if there’s an exceptional reason. Some people have been jailed for nonpayment of council tax.

The court will be able to find out more about your financial circumstances and the reasons behind the missed payments. They will also be able to ask you about your assets and how you intend to pay the balance. By making a decent offer and displaying a willingness to engage with the council, you’ll be able to minimise the effects of future legal action.

How to Deal With Council Tax Arrears was first seen on Apply for an IVA