How to Avoid Being a Victim of Marston Holdings Collections

.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

If you fall behind on your car loan, you could face a visit from Marston Holdings enforcement agents. They have a sophisticated database that they will use to collect payment. These agents can even visit your home and remove personal items that they can sell to pay for the arrears. If you are behind on your car loan, you can learn how to avoid being a victim of this company. Here are some tips to avoid being the victim of Marston Holdings collection efforts.

Marston Holdings is the UK’s largest provider of transportation and enforcement services

With a long history in the transportation industry, Marston Holdings is a world-leading provider of integrated technology solutions that support transport and enforcement policies. Its newest solution, video camera monitoring, will enable councils to more effectively enforce traffic regulations. The new solution also allows councils to track and identify foreign-registered vehicles. This type of vehicle is more likely to breach traffic laws and pay penalty charges than a UK-registered vehicle.

The company has acquired Vortex, a developer of intelligent traffic management solutions, following acquisitions of ParkTrade and Videalert. These three acquisitions strengthen Marston’s transportation technology division and better position the company to respond to client needs. Vortex will provide data analytics and artificial intelligence-based traffic management solutions, enhancing Marston’s ability to meet the needs of its client base.

It is regulated by the Ministry of Justice

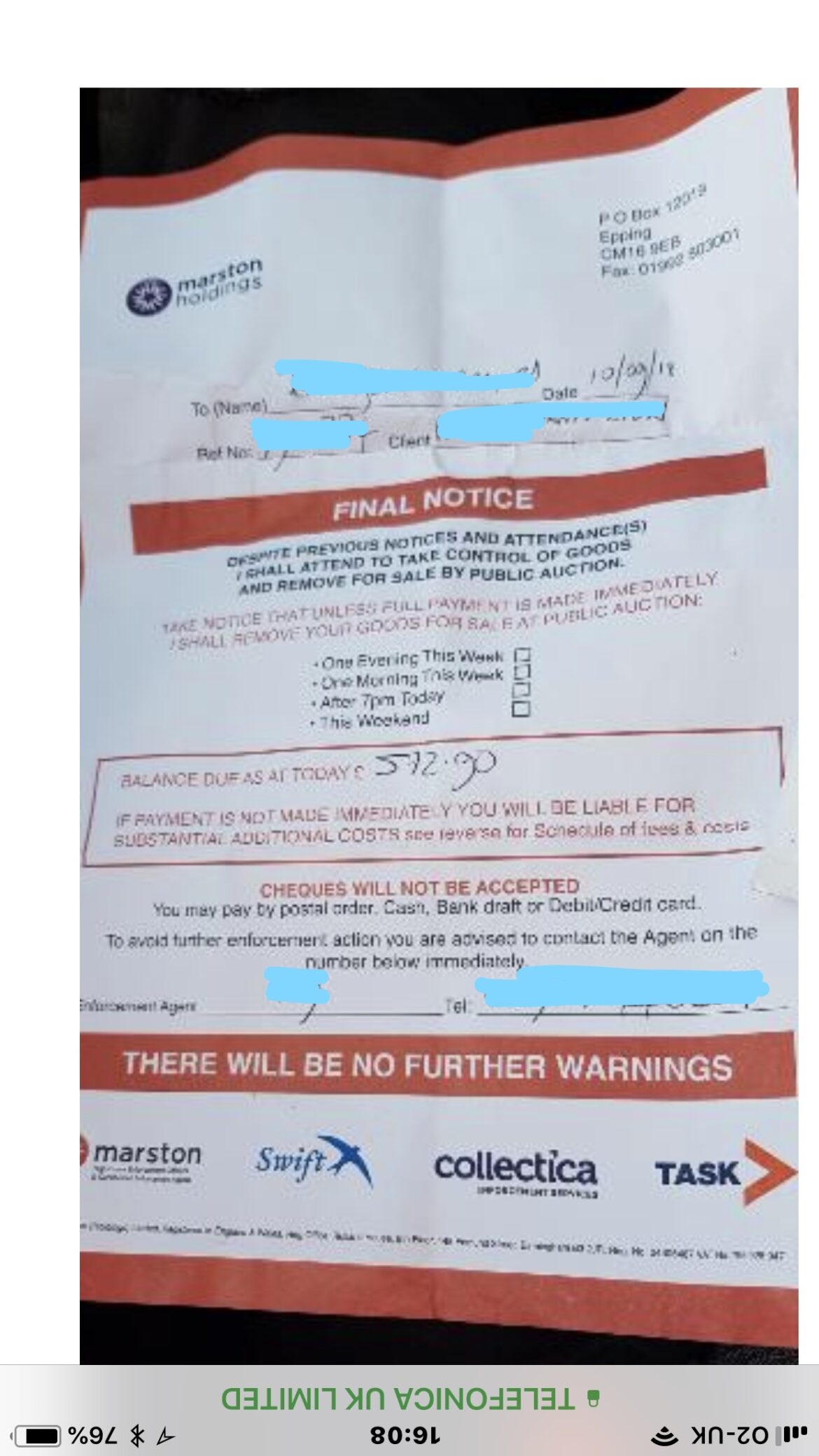

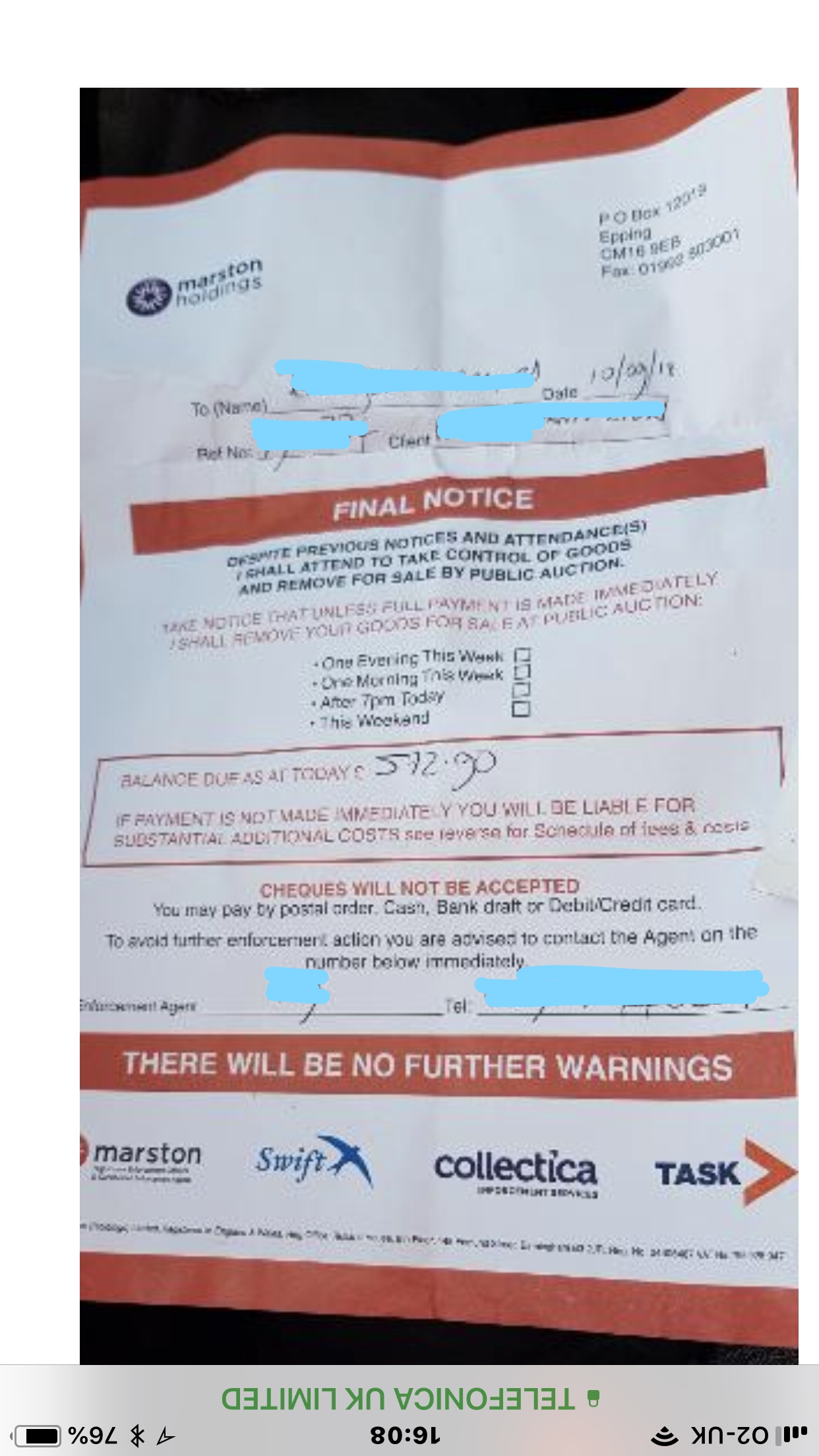

If you have a debt with Marston Holdings, you should be aware of the fees it charges. These fees can range from bailiff action to enforcement to the sale of goods. You should always ask for this information before hiring an enforcement agent. A company that charges you by the step can increase your debt by swindling you out of your hard-earned money. Luckily, there are options to reduce the fees that these companies charge.

Marston Holdings is a UK-based debt enforcement and judicial services group that employs over 2,000 people and self-employed agents. They recover over PS300 million a year for businesses and taxpayers. You can get free debt advice from Marston Holdings before they take action. You will have 7 days to pay the debt before they visit. They may also take steps to regain custody of your assets if you cannot afford to pay.

It can seize your car if you are in arrears on your car loan

You’re in arrears on your car loan, but you don’t have to face the prospect of having your car repossessed. Marston Holdings has over 500 clients and works with the government and local councils. They deal with unpaid bills, such as VAT invoices and benefit overpayments. Marston Holdings can also seize high-value items you don’t want to sell.

If you have fallen behind on your car loan, you can fight to keep it. You should contact Marston Holdings and ask for a payment plan. The company can use a sophisticated database to find your address. If they can’t find you, they may send bailiffs to your home or your workplace. If your car is worth less than £1,000, you should contact your lender.

It recovers debt from employment tribunal awards

Debt recovery companies, like Marston Holdings, act on behalf of taxpayers to recover unpaid employment tribunal awards. These companies act on behalf of employees in a variety of cases, from unpaid wages to unpaid invoices of small businesses. As one of the largest judicial service groups in the UK, Marston works to recover debt that is due to taxpayers. To get the best deal, you should contact a consumer debt advice organisation for help.

Once you have been awarded a debt, Marston Holdings will contact you. A letter will be sent to you, detailing the amount you owe, any penalty charges, and the deadline for repayment. You can expect to receive a home visit or even a seizure of your property, depending on the nature of the debt. If you do not pay the debt within a specified time frame, Marston Holdings will pursue collection action by issuing a County Court Judgement. This judgment is legal, but can be challenged by you. The debtor can opt to pay it with money or even sell a property in order to get the full amount.

How to Avoid Being a Victim of Marston Holdings Collections was first seen on Debt Worries