How Bankruptcy Can Help You Get Back on Your Feet Financially

Bankruptcy is a legal process that can help you get back on your feet financially. Bankruptcy can help you get your debt under control, so you can manage your money in a new way. It can also protect your home and car. Bankruptcy is a legal option for those who owe a lot of money, but cannot pay it back.

If you are considering filing for bankruptcy, you must educate yourself about the process. Moreover, you should prepare your financial records. This will give you a better understanding of your situation. Then, you can make the right decisions for your financial future. A bankruptcy trustee will work with you to negotiate with your creditors and make a plan to pay off your debt.

The reason why people file for bankruptcy is that they can’t make their payments. The bankruptcy code was introduced to give people another chance. If you are unable to pay your debts for at least five years, bankruptcy is your best option. It is legal, safe, and practical. In fact, it has helped millions of people to get back on their feet financially.

The best way to prepare for bankruptcy is to sell valuable possessions before filing. In addition, you should sell any items that are worth more than your debt. You should also sell off anything that you don’t use or don’t need. In some cases, assets may be sold by the bankruptcy trustee. Unless you are able to prevent the liquidation of your assets, you won’t have much control over what happens to your property.

Once you have filed for bankruptcy, you need to notify your creditors. They’ll then have 60 days to get in touch with you to get payment for your debts. If your creditors don’t receive a payment, the trustee can sell your assets to make up the debt. If you don’t have a steady income, you can also hire a financial counsellor. These people are free and can help you determine your best course of action.

While bankruptcy can be an effective financial solution for many people, it isn’t a good option for everyone. Bankruptcy can affect your credit, job search, and ability to buy a home or start a business. If you owe a mortgage or car loan, you will still have to make payments. Likewise, bankruptcy won’t discharge your debts if you owe any alimony or child support.

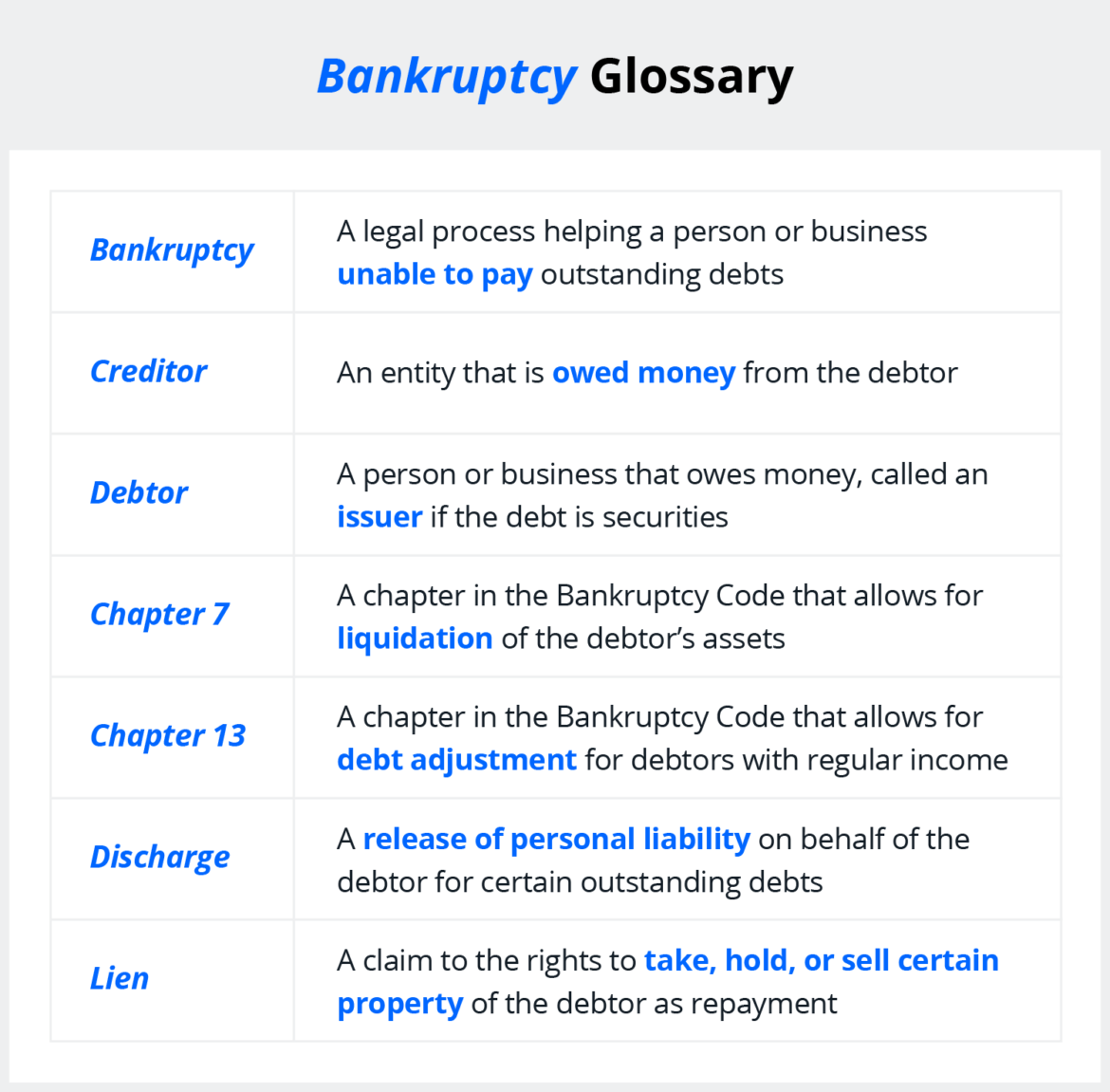

Bankruptcy has several types and you may need to decide which one is right for you. Chapter 7 is the most common type of bankruptcy, but there are also Chapter 11 and chapter 12 for businesses and family farmers. If you don’t have a steady income, you may consider Chapter 7. In this case, you can liquidate your assets and pay off the creditors.

Chapter 7 bankruptcy can help you get out of debt. The debtor must meet a state’s “means test” to qualify. This test compares your income to the state’s median income and looks at your finances to determine whether you have enough disposable income to make ends meet. If you don’t meet these criteria, you may be ineligible for Chapter 7.

How Bankruptcy Can Help You Get Back on Your Feet Financially was first seen on Apply for an IVA