Debt Management Plan – What You Need to Know

If you are struggling to pay off your bills, a debt management plan may be just what the doctor ordered. In fact, these plans can actually lower your interest rates, which can help you save money. They also provide a useful budget tool, though you should make sure to use a credit counselor or other qualified professional for this kind of advice.

The right debt management plan can allow you to reduce your payments and even eliminate them entirely. It is possible to negotiate lower interest rates and fee waivers, but you will need to talk to your creditors in order to find out what kind of concessions they are willing to give. Some offer the services for free, while others charge. However, you can often get the same level of assistance by using a nonprofit credit counseling service.

When selecting a credit counselor, look for a certified one, or at least a company with a good reputation. Check with your local consumer protection agency to verify their credentials. Also ask about fees and success rates. Be sure to check the Better Business Bureau, too.

A credit counseling agency can be a nonprofit or for-profit entity. You should read their contracts to ensure they are not a scam. And be sure to ask about the monthly fee. This can range from $20 to $30. Depending on the organization you choose, the fee might be waived if you meet certain qualifications.

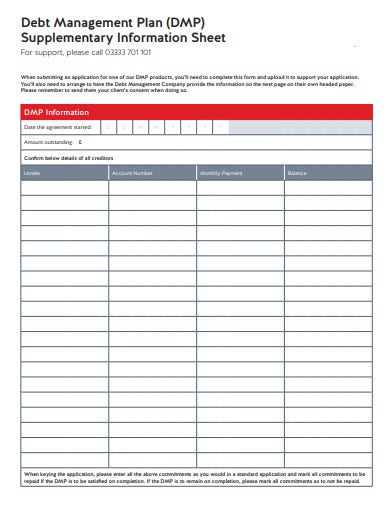

To participate in a debt management plan, you will need to stop applying for new credit cards and avoid making any new financial commitments. You will also have to make regular payments to a nonprofit debt counseling agency, who then disburses these funds to your creditors.

While a debt management plan is not a cure for the disease of overspending, it can help you stay on top of your finances. As long as you make on time payments, you will likely see a reduction in your payments and your interest rate. But remember that it takes a little time to implement a plan and you will have to adjust to a cash-only lifestyle.

Most nonprofit debt management companies will help you develop a realistic budget and show you where to cut costs. For example, they might suggest a credit card you can use only for emergencies.

Although a debt management plan won’t cure your debt, it can be a positive factor in your credit score. Creditors will typically agree to reduce the rates they charge you, and you will be able to make a monthly payment to a nonprofit credit counseling organization that will distribute it directly to your creditors.

It is best to consult with a professional before enrolling in a debt management program, and you should beware of companies that promise to repair your credit for a fee. Many reputable organizations offer free sessions. Read all the terms and conditions of the contract before signing on the dotted line.

Debt Management Plan – What You Need to Know was first seen on Debt Worries