DCBL Bailiffs and How to Avoid Them

Many people have a misconception about DCBL Bailiffs. What is the difference between a DCBL Bailiff and a DCBL debt recovery company? Before we go any further, we must clarify what a bailiff actually does. We’ll also explain what bailiffs can and cannot do. DCBL Bailiffs, or debt collection agencies, may threaten you with bankruptcy or take action against you.

DCBL is a debt recovery company

Debt Recovery companies are allowed to visit people’s homes, but many people are not aware that DCBL Bailiffs can seize property as well. Debt recovery companies use DCBL Bailiffs as a means of collecting money that is owed to a debtor. Once they have a CCJ, DCBL can apply for an attachment of earnings order. The court document instructs the debtor’s employer to send a certain percentage of their wages to the DCBL. This process must continue until the balance is cleared.

You can report complaints to the Financial Ombudsman Service, which will investigate the complaint and possibly revoke the debt recovery company’s license. You can also find a list of all debt recovery companies on Trustpilot, where you can read reviews from people who have used DCBL Bailiffs. If you have any questions about DCBL Bailiffs, talk to a debt adviser or take a debt quiz. These resources will help you make an informed decision about which debt solution is best for you.

It is not a bailiff

If you are facing unpaid debts, you may have received a visit from a DCBL bailiff. These enforcement agents must provide you with at least seven days’ notice of their first visit. After this time, they can enter your home through the window or door and may take items outside of your home. DCBL bailiffs are required by law to charge PS235 per enforcement visit. Here are some tips to avoid them.

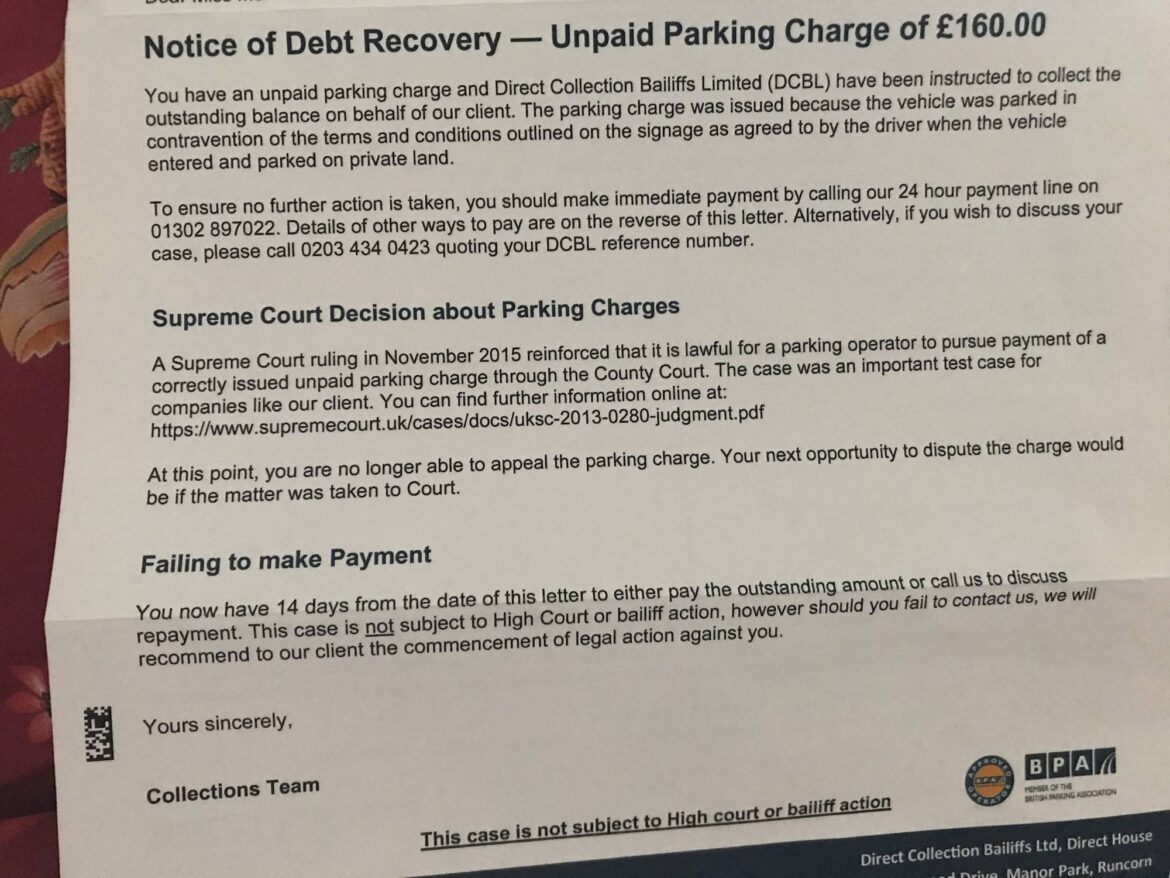

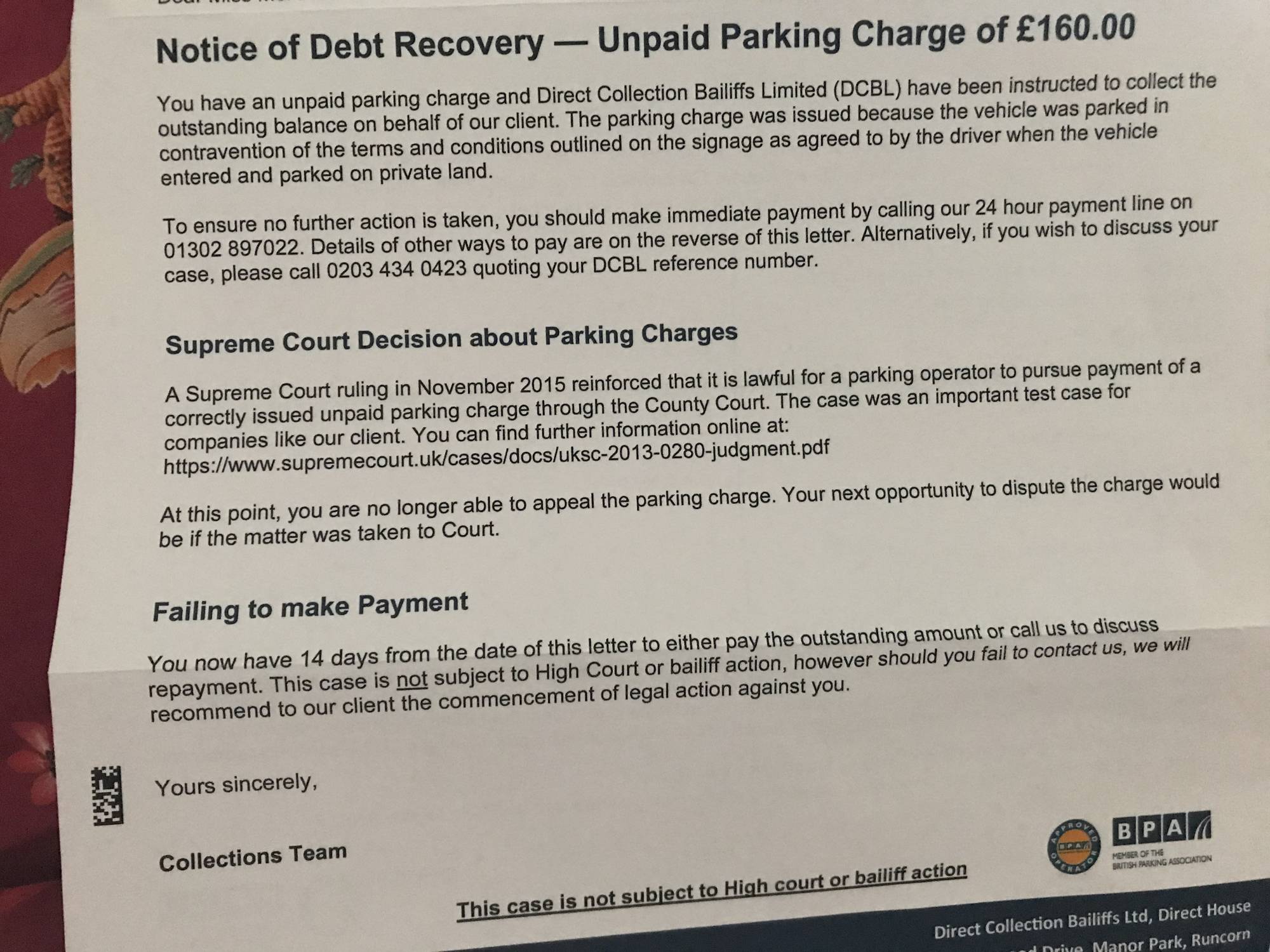

First of all, you should always check the name of the company that sent the letter. DCBL stands for Direct Collection Bailiffs Limited. It is the trading name of a company that carries out high court debt enforcement on behalf of its clients. After obtaining the debt, the DCBL bailiff will contact the debtor and explain why they are pursuing it. The letter will give them seven days to repay the debt in full or contact the company to discuss options.

It can take action against you

If you do not pay your debts in full, DCBL bailiffs can take action against you. These enforcement agents are required by law to give you seven days’ notice before visiting your property. Once they are granted access to your property, they may take items from your home or sell them at public auction. In some cases, bailiffs can use illegal tactics such as bullying or pressure to collect debts.

The best way to avoid a visit from a DCBL bailiff is to repay your debts in full or agree on a repayment plan. There are many methods of debt repayment, and the simplest is to repay the debt in full or agree to a manageable payment plan. Burying your head in the sand will just make the situation worse and may result in a DCBL visit. If you owe PS5,000 or more, you may qualify for an Individual Voluntary Arrangement.

It can threaten bankruptcy

Debt collection companies are notorious for using questionable tactics to collect debt. They may resort to bullying and pressure, or make numerous phone calls to try and get you to pay up. It can be frightening to receive a letter from DCBL threatening bankruptcy. It’s important to avoid being intimidated by these debt collection agencies, as their actions can make your debt problems worse. Read on for tips on dealing with DCBL bailiffs and how you can protect yourself from them.

You can protect yourself from DCBL by not giving them the information that they want. DCBL uses advanced technology and tracing services to find debtors, which means they can threaten bankruptcy if you don’t pay. However, the staff of DCBL will not settle for anything less than the full amount due. To be safe, don’t be afraid to contact the Financial Ombudsman to find out if DCBL has been trying to harass you, and how to stop them.

It can collect debt without recourse to a court

The best way to avoid having a DCBL Bailiff visit your home is to repay your debt in full or to agree on a payment plan that you can afford. Avoid burying your head in the sand, as this could result in a DCBL visit. You can also try an Individual Voluntary Arrangement (IVA) for debts of PS5,000 or more.

Firstly, you can contact the DCBL and ask them to contact you. The DCBL will ask for proof of your debt, such as a utility bill agreement or council tax default. You can send them a letter to show them the proof, but this isn’t a guarantee that they will take action. If you fail to pay the debt, DCBL will be able to attach a proportion of your wages until you’ve paid off the debt.

DCBL Bailiffs and How to Avoid Them was first seen on Apply for an IVA