CDER Group – Who Owns CDER Group?

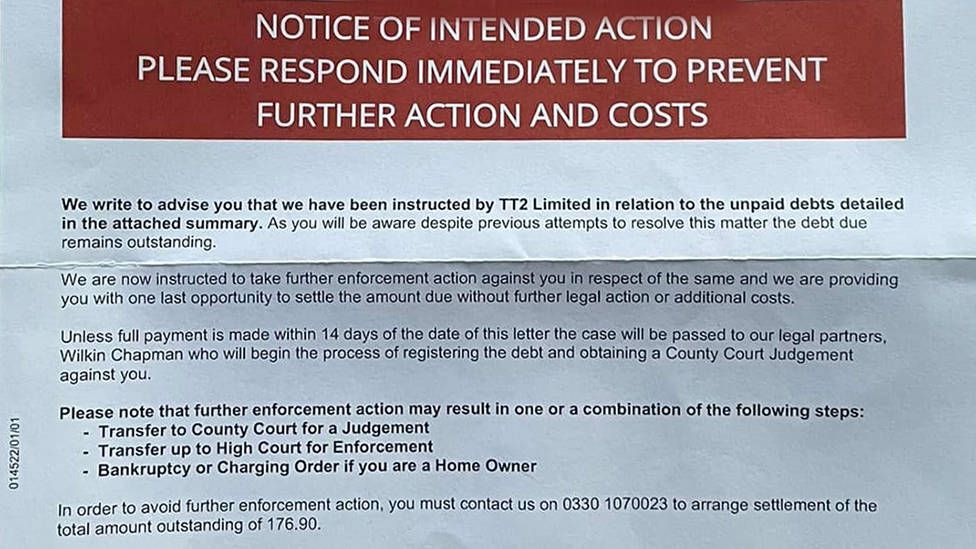

You may have received debt letters from CDER Group, or even been served with bailiffs. In these instances, it is important to read and understand the guidance provided by the company, and to know your rights when fighting back. There are many different ways to get out of debt, and choosing the right one will help you save time and avoid further damage.

CDER Group is a legitimate debt collection company

The CDER Group is a legitimate debt collection firm based in England. Its operations are scrutinised by an Independent Advisory Group. The firm was formed in 2020 after merging three smaller companies. Its most recent acquisition is Advantis, which is authorised by the Financial Conduct Authority. Its debt collection techniques adhere to a number of laws to protect the public.

If you get a letter from the CDER Group, read it carefully. If it does not explain the debt breakdown clearly, it could be a scam. You should also never let an enforcement agent force their way inside your home. This may lead to more debt and further harassment.

CDER Group may take your car if you’re in arrears. However, this is only possible if your car is not on a disabled sticker. In addition, if the company can prove that you’re a vulnerable debtor, they can take it.

It uses Ecospend’s ‘Pay-by-Bank’ solution

CDER Group, which collects more than PS250 million of unpaid debt every year, has partnered with Ecospend to make account-to-account payments easier for their customers. This solution allows users to make payments from their own banking app without sharing any card or personal information.

Ecospend provides open banking technology for financial institutions. This partnership allows customers to make one-off account-to-account payments and get back on track with repayment plans. Customers can make the payment online or by phone, with the service moving money from their bank accounts in real-time. To complete the transaction, customers must log into their online banking account and authorise the transaction using secure biometrics.

Ecospend is an FCA-regulated financial technology company that powers the next generation of payment and financial data services. This unique end-to-end technology empowers Ecospend to deliver comprehensive solutions without relying on third-party technology or legacy systems.

It is regulated by the Financial Conduct Authority

The CDER Group is regulated by the Financial conduct Authority, which is the body that regulates financial services providers in the UK. The FCA has appointed an independent Advisory Panel to oversee the CDER Group. This panel consists of six independent members, including Sir Martin Dawson, who was previously the first Chief Executive of the National Offender Management Service. Sir Martin has extensive experience in the sector, and he recently was knighted for his services to the community.

The CDER Group is a UK-registered debt collection company that has undergone rigorous scrutiny by the Independent Advisory Group. The company was formed following a merger of three firms in 2020. In addition to Phoenix Commercial Collections, the company also acquired Advantis, a regulated debt collection business.

The CDER Group is a legitimate company based in London. It is registered in England, and its operations are monitored by an Independent Advisory Group. Founded in 2020, the CDER Group is a combination of three firms and is authorised by the Financial Conduct Authority. It collects PS250 million of debt annually from commercial and local government clients. It is one of the 780 debt collection agencies in the UK.

It is an equal opportunities employer

As an equal opportunities employer, CDER Group Ltd is committed to attracting and retaining the best people. We don’t discriminate against anyone, and we’re proud to celebrate our employees’ diverse backgrounds, perspectives and skills. If you’d like to join us, please submit your application.

CDER Group – Who Owns CDER Group? was first seen on Debt Worries