Investing in Trust Deeds

If you’re interested in trust deed investments, you should hire a broker. A broker specializes in trust deeds, and can recommend investments based on their specific lending criteria and risk tolerance. While investing directly with a Borrower can be risky, working with a third party broker can allow you to work towards mutually beneficial outcomes. This is especially important if you’re unsure of what you want to accomplish with your investment.

Investing in trust deeds can offer high rates of return and diversification into another asset class. It requires little or no real estate experience, and you can take advantage of the high interest rates and diversification benefits that trust deeds can offer. While trust deeds are considered a passive investment, there are still risks associated with them. Because they are a form of real estate, investors cannot easily withdraw their money, and their return is based solely on interest and loan payments. As such, capital appreciation is unlikely.

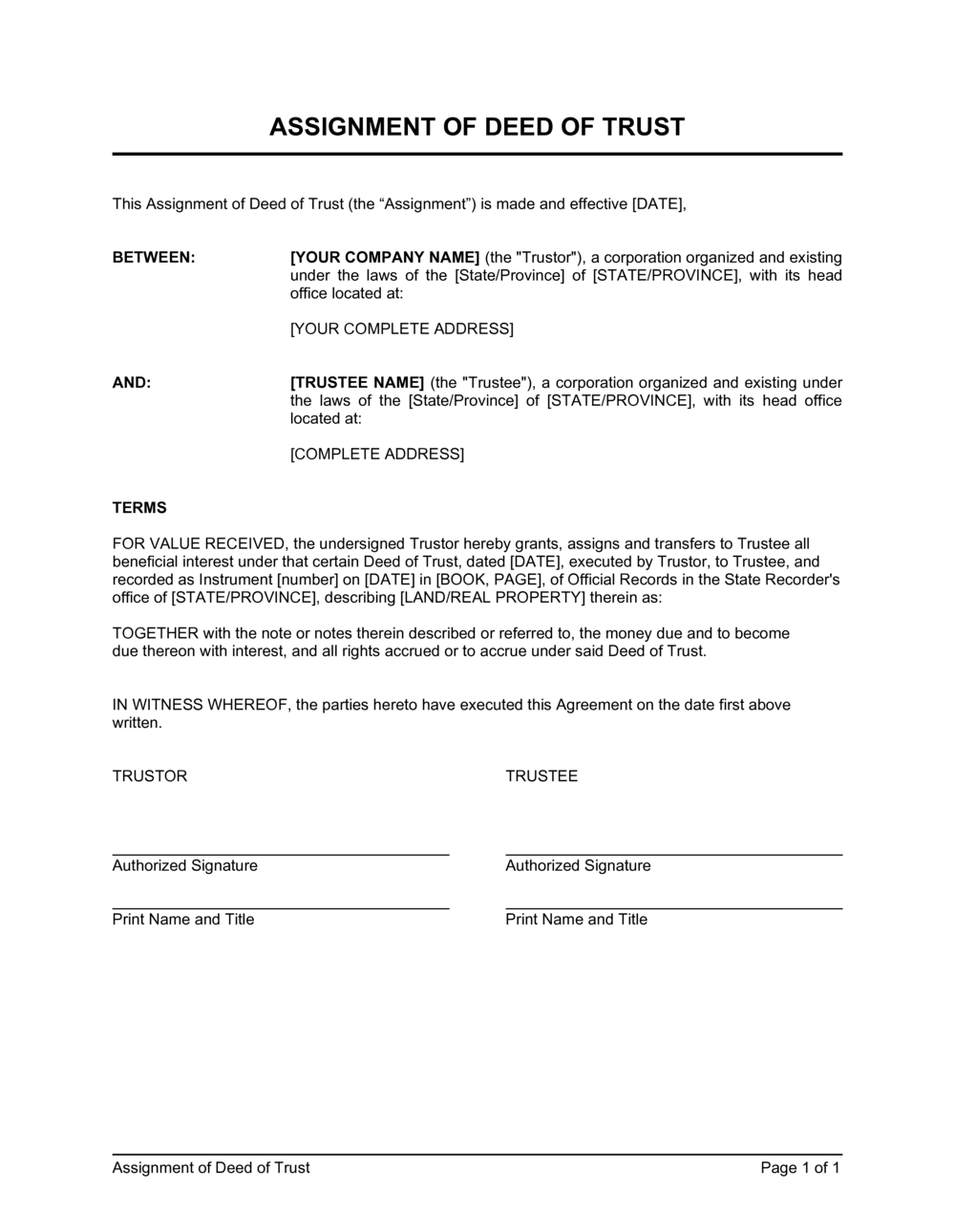

A deed of trust is recorded in public records. They are recorded with the county recorder in the county where the property is located. If you want to have your deed recorded, make sure to check the county recorder’s office to make sure that the language is accurate. Including diagrams is not a legal requirement, but they can help you avoid getting caught in a sticky situation. So, before you prepare your trust deed, take a look at the legal descriptions for your property.

The Trustor and Beneficiary are two separate entities. The Trustor holds the legal title to the property while the Beneficiary has the equitable title. The Trustee holds the legal title to the property. Both parties have an equal stake in the property. If the borrower does not pay the loan, the trustee can sell the property to recover their investment. Upon foreclosure, the lender will take full ownership of the property. This process can take years.

In addition to a trustee, a trust deed can include an additional person called the continuing trustee. In such a case, the continuing trustee can exercise authority over trust property. The continuing trustee can also be held responsible for breaching the trust. The trustee can also be appointed if any of the original trustees die. However, if there is no successor to the trust, the courts may appoint a trustee.

The trust deed is a different type of deed than a traditional mortgage. While the purpose of a trust deed is to transfer ownership of property, it’s different from a mortgage. A mortgage transfers title to real estate to a third party, but the lender holds the true ownership. A trust deed is similar to a mortgage, which has a lien against the borrower’s property. A mortgage is similar to a trust deed, but the borrower is not required to repay a specific amount.

While mortgages involve two parties, trust deeds typically have three parties. Both parties agree to the terms of the deed. When a borrower defaults on his or her loan, the lender must go through the courts to obtain a judgment. In contrast, a trust deed can be resolved through a nonjudicial foreclosure process. The trustee will hold the property title in the event of a default. The trustee’s ability to enforce the agreement may be crucial to the borrower’s repayment.

Investing in Trust Deeds was first seen on Pathway IT