Important Things to Keep in Mind When Drafting a Trust Deed

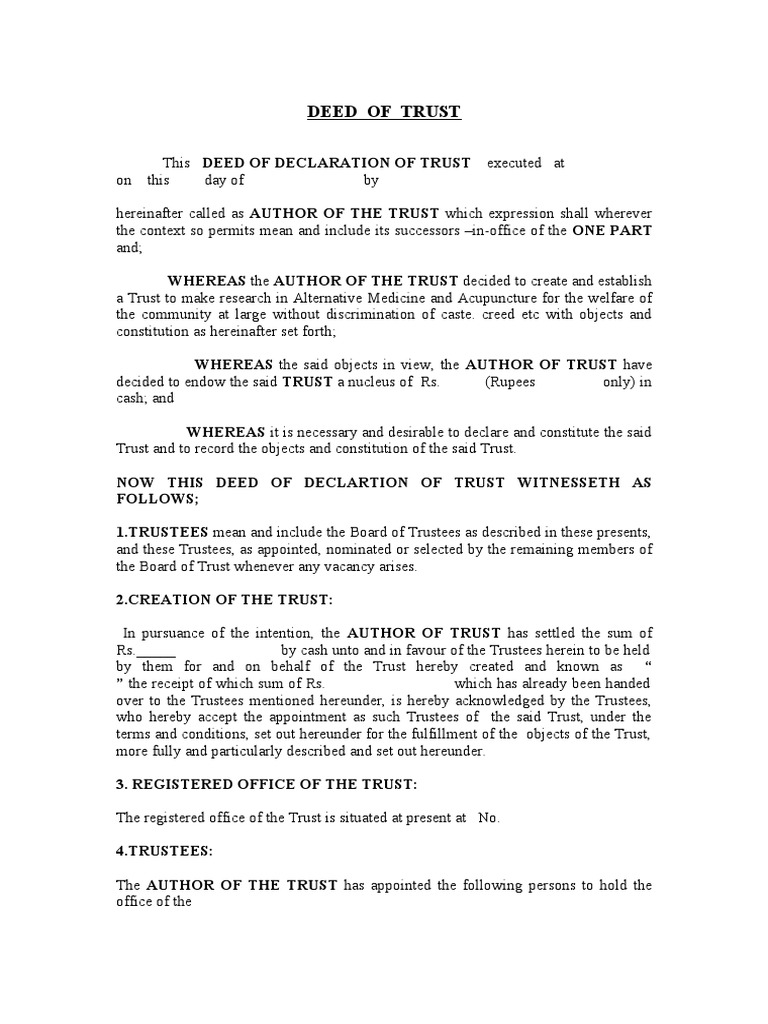

A trust deed is a legal instrument in the realm of real estate in the United States. It transfers legal title of real property to an entity known as a trustee, who then holds the property as security for a loan. Trusts can be complex, so it is crucial to have the legal knowledge and understanding of the process. Listed below are some important things to keep in mind when drafting a trust deed.

A trust deed is a legal document transferring legal title of a property to a third party, usually a title company. In a trust deed, the borrower transfers the legal title of a property to the trustee, who holds the property in trust for the borrower. Trust deeds usually contain a power-of-sale clause, which enables the trustee to sell the property without a judicial auction. This is advantageous for the lender, as a judicial foreclosure can take years.

A trust deed broker may be beneficial for investors because of their experience and knowledge of real estate lending. While working directly with a Borrower may be advantageous, this arrangement can put you at risk of a conflict of interest. A third-party broker can ensure the best possible outcome for both parties and minimize the risk of a bad investment. There are also risks associated with investing in trust deeds. Using a licensed broker is recommended.

Despite the high risk of trust deeds, trust deed investing can provide attractive returns. The returns will depend on the property, agreement, and parties involved. However, if you do thorough due diligence, trust deed investing can provide you with a return between eight to twelve percent. Though this method is not guaranteed, the risk involved is manageable. A good performing borrower can mitigate the risk involved in trust deed investments.

When choosing a lender, make sure to consider the loan terms. Your loan terms will depend on the type of transaction you are purchasing. For a smaller balance residential transaction, terms are often three years balloon, and fully amortized over thirty years. For super-jumbo or jumbo transactions, loan terms can range from six months to five years. You may also opt for interest-only financing if this suits your needs. Once you’ve chosen a lender, choose a trust deed that will give you the security and peace of mind you need.

While trust deed foreclosure is much faster and less expensive than judicial foreclosure, you must keep in mind that a non-judicial foreclosure process has the same risk as a contested one. The non-judicial process follows state laws and involves the trustee selling the property to the highest bidder. As a result, the property is sold and the new owner takes possession. In addition, the buyer does not have a right of redemption.

A trust deed is similar to a mortgage, with three parties involved: the lender, the beneficiary, and the borrower. A trust deed must be signed before the loan can be executed. A mortgage binds the borrower to make payments on time and can even cause foreclosure if the loaner does not make payments. If the borrower defaults on the payments, the lender will foreclose on the property, evict the current occupants, and sell the property.

Important Things to Keep in Mind When Drafting a Trust Deed was first seen on Pathway IT