How to Avoid Being Sued by Marston Holdings

.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#818a91;color:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{color:#818a91;border:3px solid;background-color:transparent}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;height:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:center;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{display:inline-block}

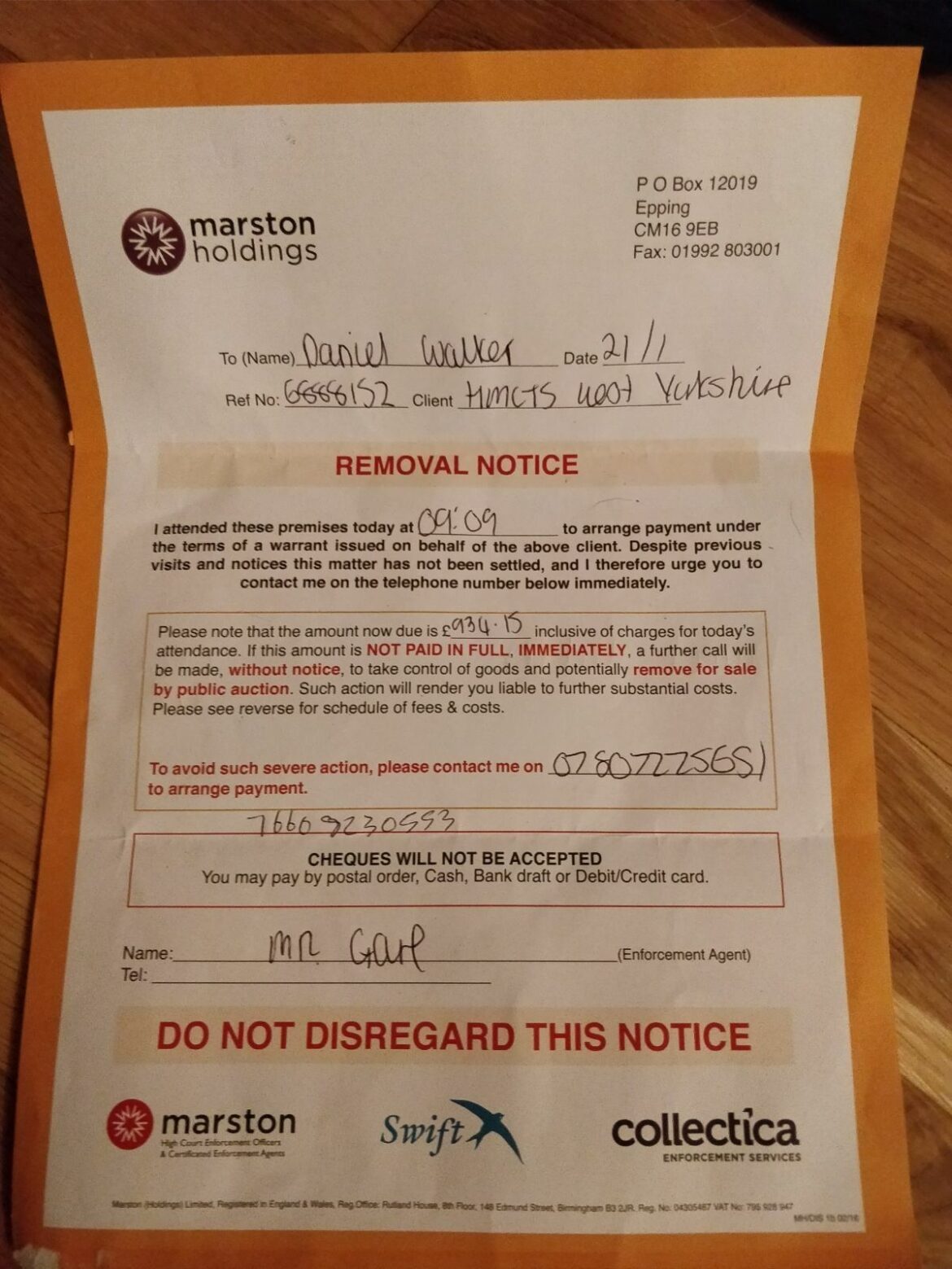

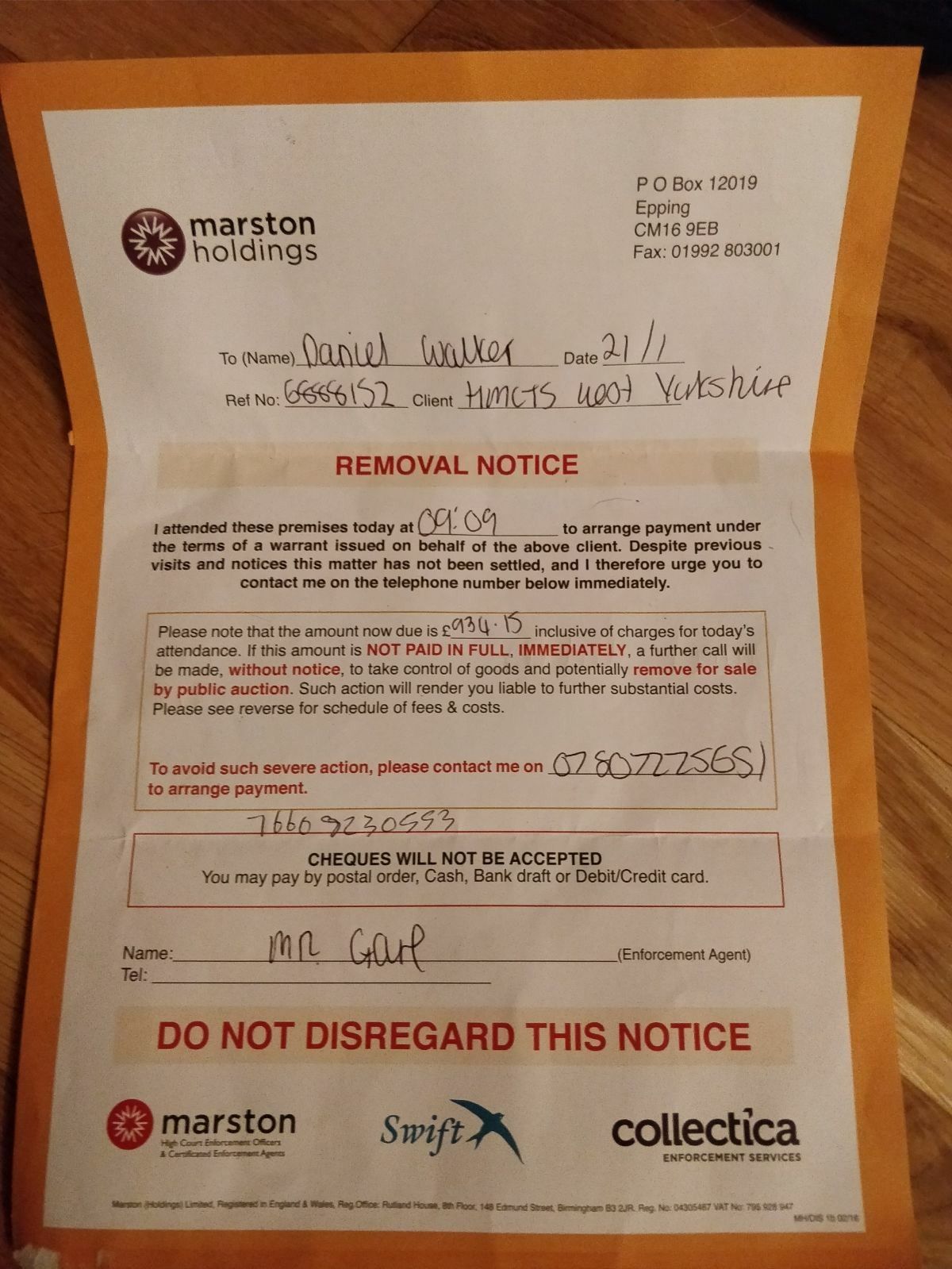

If you fall behind on your payments and are not able to pay, you may be at risk of being pursued by Marston Holdings. The company is well known for its sophisticated database of debtors, and enforcement agents may even visit your home and repossess your personal items. While this situation can be frightening, there are ways to avoid being pursued by these collections agents. Here are some steps you can take to avoid getting sued by Marston Holdings.

Marston Holdings buys out Sheffield rival Grosvenor Services Group

Known for its technology-enabled merchandise, Marston Holdings has acquired the Sheffield-based debt collection group, Grosvenor Services Group. The new company will be rebranded as Have interaction, and will continue to provide debt collection services for utility companies. The company conducts more than 50,000 visits per month in the UK, and will also benefit from the increased expertise of its field-based teams.

The acquisition was made possible by the combined strength of the companies’ technology capabilities and their strong relationships with the local community. Marston Holdings’ Foot Anstey team was led by Adam McKenna and Beth Donnelly, and was assisted by Ashley Avery and James Barnett. In total, Foot Anstey supported the Marston team on four of its acquisitions.

It is now known as Rossendales

The Marston Group has acquired a debt collection agency and bailiff business based in Helmshore. It has backing from Lloyds Bank, the Rothschild Group, and Inflexion Private Equity. Many of Rossendales’ staff will remain on the payroll. The firm will keep its 200 bailiffs, including many based in East Lancashire. In addition, it has appointed an independent advisory board to oversee ethical governance.

The enforcement department of Marston Holdings has more than 100 officers, all with a license from the Ministry of Justice. Enforcement officers have the authority to take possession of assets in order to collect debts. In many instances, Marston enforcement agents are crude and intimidating. Listed below are some tactics these agents use. You should be aware of these tactics, which are distasteful and intimidating.

It is regulated by the Ministry of Justice

If you are facing debt problems, you may be wondering how to get out from under the control of Marston Holdings. Marston is a judicial enforcement agency regulated by the Ministry of Justice. They work with creditors and local councils to collect debts, but you should first discuss a debt solution with them. If you do not have the money, you may be able to reduce your debt by negotiating a payment plan.

In the UK, most criminal court cases begin in Magistrates’ Courts. Marston enforces these fines – the vast majority of court sentences. They also arrest offenders, transport them to the courts, and hold them in prison cells. They continue to enforce fines, even after they are convicted. But Marston does not only enforce fines, they also take away property from people.

It can take your car under a Control of Goods Order

If you are late paying your car loan, Marston Holdings can seize your car. If the car is financed, it will not be seized. However, if the car has a low value, Marston Holdings may be able to keep it. In order for bailiffs to seize the car, they must use reasonable means, including a locksmith or breaking down doors.

If the car is under a Control of Goods Order, you may need to give up your rights. You should transfer ownership of the car to a friend or relative. If you don’t want to give up your car, bailiffs can clamp the vehicle and persuade you to sign a controlled goods agreement. If you refuse to sign such an agreement, Marston Holdings will take your car under a Control of Goods Order.

It collects debt from employment tribunal awards

If you are struggling with an employment tribunal award, you should consider applying for a debt solution. You can find a solution in the UK. In fact, you may be able to completely eliminate your debt by applying for a Marston debt solution. To get started, fill out a 5 step form. This will help you to understand your options and how to best approach the Marston company.

First, Marston Holdings will contact you and ask for payment. They will send a letter stating how much you owe, any penalty charges, and the date by which you need to pay the money. If you do not pay the debt by the deadline, they could visit you at home or try to seize your property. Finally, they can take your money and sell it to recover the debt.

How to Avoid Being Sued by Marston Holdings was first seen on Help with My Debt